Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

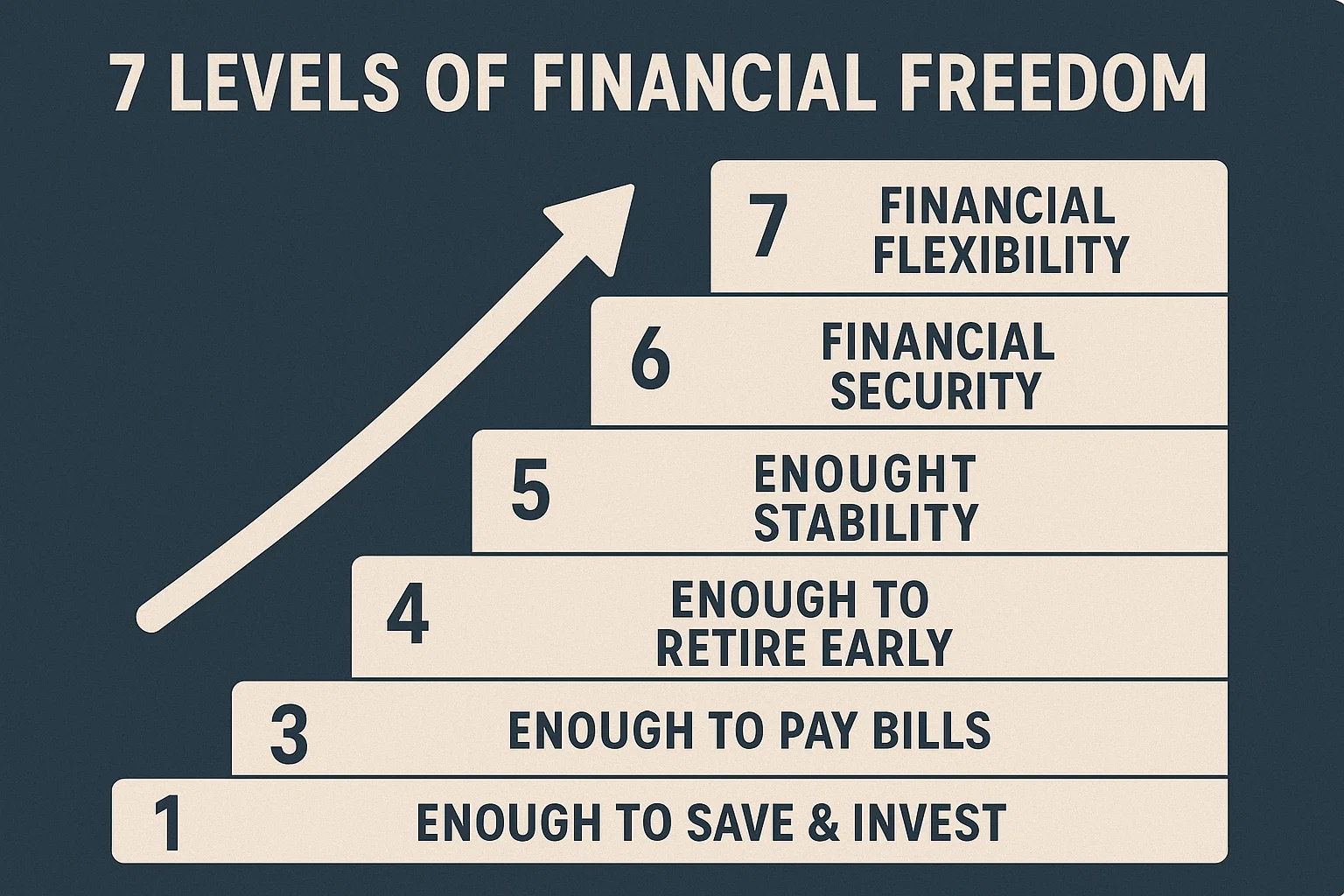

Financial freedom isn’t one big leap — it’s a journey through stages.

From surviving paycheck to paycheck to building generational wealth, the 7 levels of financial freedom give you a roadmap. Once you know where you stand, you can plan your next smart move.

Let’s break down each level.

At this stage, you depend entirely on:

Parents or family

Loans or subsidies

Donations or government help

You’re not earning independently, and you might not even have a bank account.

Goal: Start earning. Open a savings account. Build your first ₹1,000 fund.

You’re earning enough to:

Cover basic expenses

Pay minimum on loans

Avoid new debt

But you’re still vulnerable. One emergency could break the system.

Goal: Build an emergency fund (₹5,000–₹50,000) and track your spending.

At this level, you:

Pay bills on time

Have little to no debt

Save small amounts monthly

You’re stable, but not truly secure yet.

Goal: Build a 3-month emergency fund and start SIPs.

You’ve achieved:

Consistent investing (Mutual Funds, PPF, or Crypto)

Insurance coverage (Health + Term)

Backup income skills

You’re prepared for job loss, emergencies, and minor economic shocks.

Goal: Increase investments. Explore side income.

Now you have:

6–12 months of expenses saved

Ability to take breaks, switch careers, or start a business

A growing investment portfolio

Money gives you choice, not just survival.

Goal: Increase income sources. Build long-term wealth vehicles.

You’ve reached the point where:

Passive income > Monthly expenses

You don’t need a job to survive

You choose work for passion, not paycheck

This is the true FIRE zone (Financial Independence, Retire Early).

Goal: Protect and scale assets. Plan for tax efficiency and legacy.

Money is no longer a worry.

You’re focused on:

Impact investing

Philanthropy

Teaching or mentoring

Generational wealth

This is financial enlightenment.

Goal: Give back. Teach others. Set up trusts and legacy plans.

A: Identify your income, savings, debt, and financial control. Most people in India are between Level 2 and 3.

A: Income helps, but consistency and habits matter more. Many high earners stay stuck due to poor planning.

A: Level 3 to 4. It requires discipline to save, invest, and resist lifestyle inflation.

A: Yes, with strong budgeting and investment habits. Side income helps speed it up.

A: It depends on your income, savings rate, and investment returns. For most, 7–15 years of consistent effort works.

Understanding the 7 levels of financial freedom gives you a clear path — and clarity brings control.

Wherever you are today, your next step is within reach.

Explore more personal finance guides, tools, and real-life wealth strategies at bit2050.com — where your journey to financial independence begins.