Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

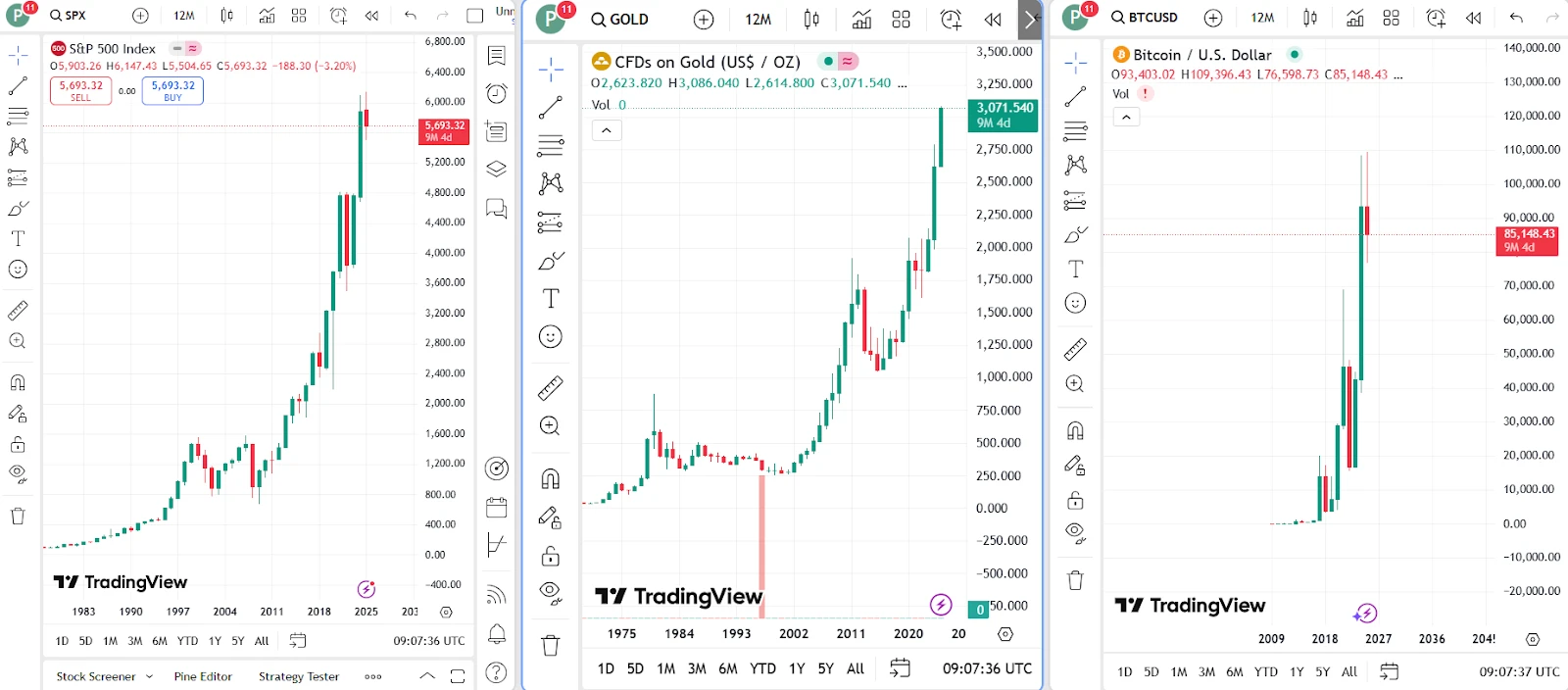

In 2025, more investors are asking the same question: Crypto vs Stocks — which is better? At bit2050.com, we understand that choosing the right investment can shape your financial future. Whether you’re a newbie or a seasoned investor, it’s essential to weigh both sides before putting your money into the market.

Stocks represent ownership in a company. When you buy a stock, you’re purchasing a share of that business. Stocks have been a cornerstone of investing for decades, offering dividends, long-term growth, and a more regulated environment.

Cryptocurrency is a digital asset based on blockchain technology. Unlike stocks, it’s decentralized and not issued by any government or traditional company. Popular cryptos include Bitcoin, Ethereum, and Solana, all offering high potential returns but also increased risk.

| Feature | Stocks | Crypto |

|---|---|---|

| Regulation | Heavily regulated | Light regulation |

| Volatility | Moderate | High |

| Trading Hours | Market hours only | 24/7 |

| Dividend Income | Possible | Rare |

| Ownership Type | Company ownership | Digital token/asset |

| Historical Stability | Stable | Emerging, unpredictable |

High return potential

24/7 trading

Access to DeFi and staking opportunities

High volatility

Regulatory uncertainty

No intrinsic value backing

Regulated and safer

Long-term growth potential

Dividends provide passive income

Lower returns (short term)

Market hours limited

Impacted by inflation and interest rates

Your investment should align with your risk tolerance, financial goals, and investment horizon:

If you want stability, go with stocks.

If you’re willing to take on more risk for higher reward, crypto may be your pick.

Diversifying across both may be the best strategy.

At bit2050.com, we track emerging trends. Here’s what you can expect in 2025:

More institutional investment in crypto

Crypto regulation clarity increasing confidence

Tech and AI stocks booming in the market

Growing hybrid platforms offering tokenized stocks

There’s no universal winner in the Crypto vs Stocks debate — it depends on your risk appetite and financial goals. Both offer opportunities and risks. To get the best of both worlds, consider diversifying your portfolio across both assets.

Remember, education and research are key — and that’s exactly what we offer at bit2050.com.

Yes, cryptocurrencies are typically more volatile and less regulated than stocks.

Absolutely! Diversification is a common strategy for reducing risk.

Stocks have a proven long-term track record, but crypto is gaining ground with new developments like Ethereum 2.0 and tokenized assets.

Not traditionally, but you can earn passive income through staking or yield farming.

Yes. Both crypto and stocks are subject to capital gains taxes in most countries.

Crypto vs Stocks, Cryptocurrency Investment, Stock Market, Passive Income, Crypto Education, bit2050.com, Blockchain, Bitcoin, Ethereum