Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

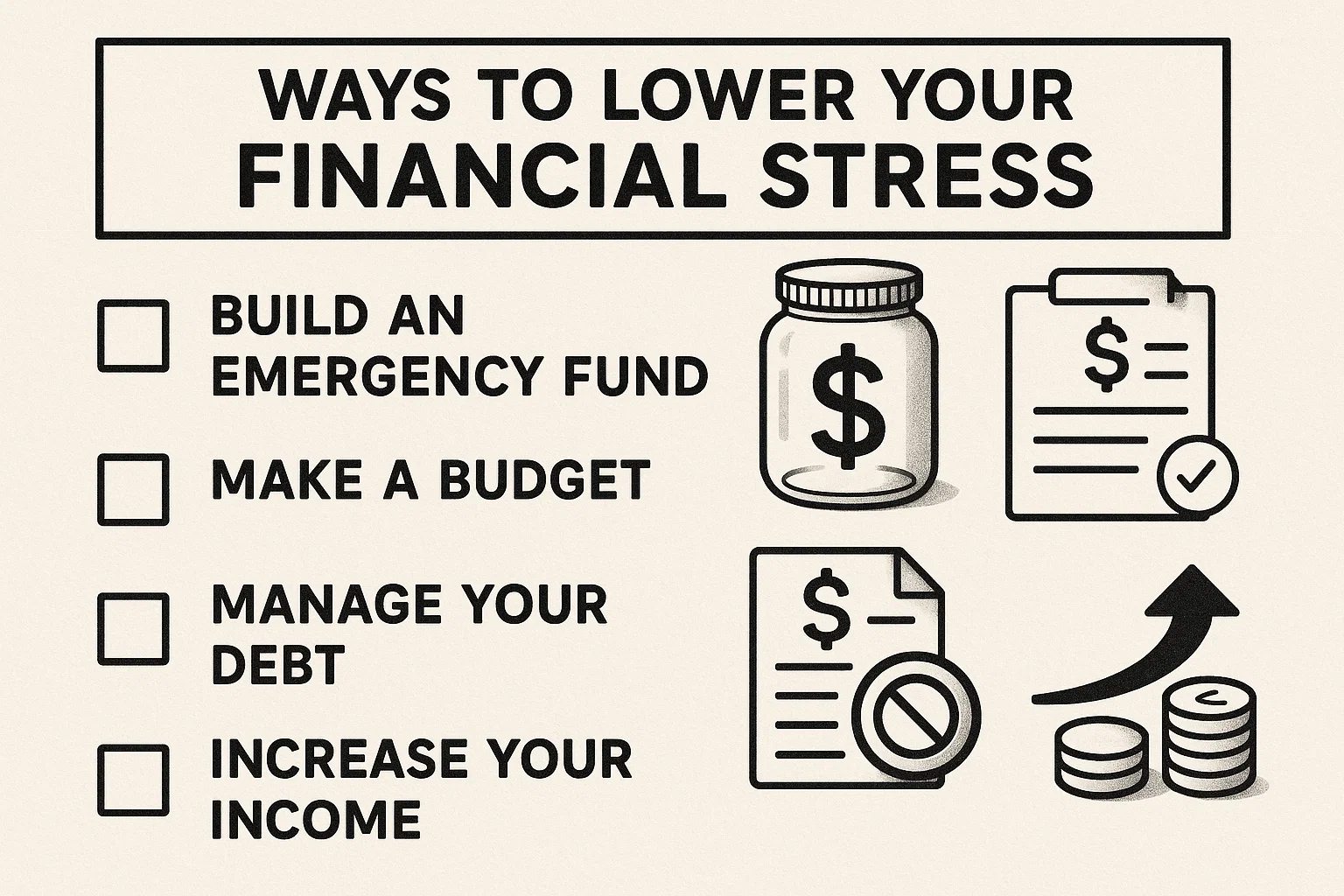

Are your finances keeping you up at night? 😟 You’re not alone. Inconsistent income, mounting bills, and inflation can trigger anxiety for anyone.

But there’s hope. By learning ways to lower your financial stress, you can regain clarity, sleep better, and even enjoy your money journey. Here are 9 powerful techniques you can start using today.

Knowing where your money goes = instant relief.

Use budgeting apps like YNAB, Mint, or a Google Sheet.

👉 Knowledge = control.

Even ₹10,000 can cushion minor emergencies.

Start small. It builds confidence and reduces panic.

Reduce forgetfulness and last-minute stress.

Auto-pay rent, SIPs, EMI, and automate 10% to savings.

Whether it’s a spouse, friend, or financial coach—talking reduces internal pressure and opens space for solutions.

Ignore the stock market’s daily noise.

Focus instead on your spending, saving, and mindset.

Overdue bills?

✔️ Call and negotiate

✔️ Create a repayment plan

✔️ Add reminders

Tiny actions reduce overwhelm.

Pause before any expense:

“Do I need this or am I escaping stress?”

Financial awareness = fewer regrets.

Try:

Save ₹5,000 this month

Cook meals at home for 2 weeks

Small wins boost confidence.

Take a walk. Journal. Meditate.

Mental clarity = better decisions about your money.

Unplanned expenses, debt, job insecurity, and lack of budgeting are top contributors.

Yes! Budgeting gives you control and visibility, which immediately reduces uncertainty.

Start with micro-steps: create a basic plan, cut one expense, and explore side income options.

Yes – try Walnut, Money Manager, Google Sheets, or apps like Goodbudget.

Many feel better within a week of tracking spending and setting up a simple plan.

You don’t need to earn more to feel at peace—you need to manage better and breathe easier. These ways to lower your financial stress work no matter your income level.

Try just one step today. Your mind—and your future self—will thank you.

Explore more financial wellness tips at bit2050.com 🔗