Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

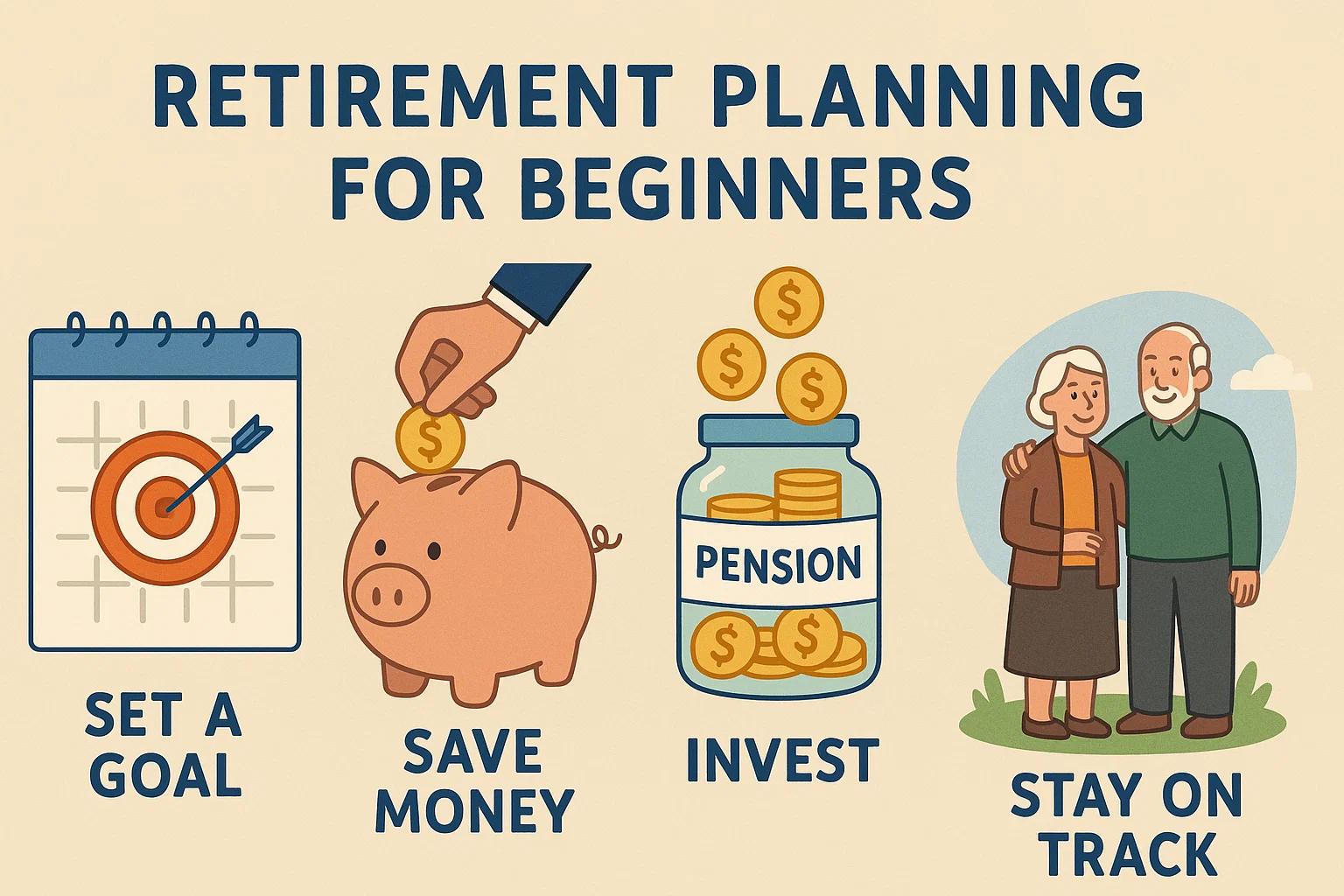

Planning for retirement may sound overwhelming, but it doesn’t have to be. With the right approach, even beginners can build a secure and comfortable retirement. This guide to simple retirement planning for beginners breaks down the process into clear, actionable steps.

Whether you’re in your 20s, 30s, or even 40s, it’s never too early — or too late — to start planning.

You won’t always be earning.

Costs will rise due to inflation.

Medical and emergency expenses increase with age.

Retirement planning gives you freedom, not fear.

Ask yourself:

At what age do I want to retire?

What will my monthly expenses be in retirement?

Where do I want to live?

Use a basic retirement calculator to get a number.

Thanks to compound interest, even ₹1,000/month can grow big over decades.

Example: Starting at 25 with ₹2,000/month at 12% returns can give you ₹2.5 crore+ by 60!

In India, beginners can explore:

EPF (Employee Provident Fund)

NPS (National Pension System)

PPF (Public Provident Fund)

Mutual Fund SIPs (Equity/Hybrid)

Diversify across these for growth + security.

Each time you get a raise, increase your savings.

Automate SIPs and contributions.

Use percentage-based rules (e.g., 10–15% of salary).

Protect your future:

Health Insurance (personal + family floater)

Term Life Insurance (especially if you have dependents)

Avoid dipping into retirement funds during emergencies.

Once a year, check:

Are you on track?

Do your investments need rebalancing?

Has your retirement goal changed?

Retirement planning is not a one-time task — it’s a living strategy.

As early as possible. Starting in your 20s gives your money more time to grow with compounding.

It depends on your lifestyle, expected age of retirement, and inflation. Use a retirement calculator to get an estimate.

Start aggressively. Increase your savings percentage, cut unnecessary expenses, and invest wisely.

Yes. Mutual funds, especially equity or hybrid SIPs, are great for long-term growth. Pair them with safer options like PPF or NPS.

Both are good. NPS gives better returns (market-linked), PPF is safer and tax-efficient. Use both if possible.

Retirement planning isn’t about millions overnight. It’s about small steps today for freedom tomorrow.

The sooner you begin, the easier it becomes. Let bit2050.com be your guide to mastering financial freedom — one smart choice at a time.