Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

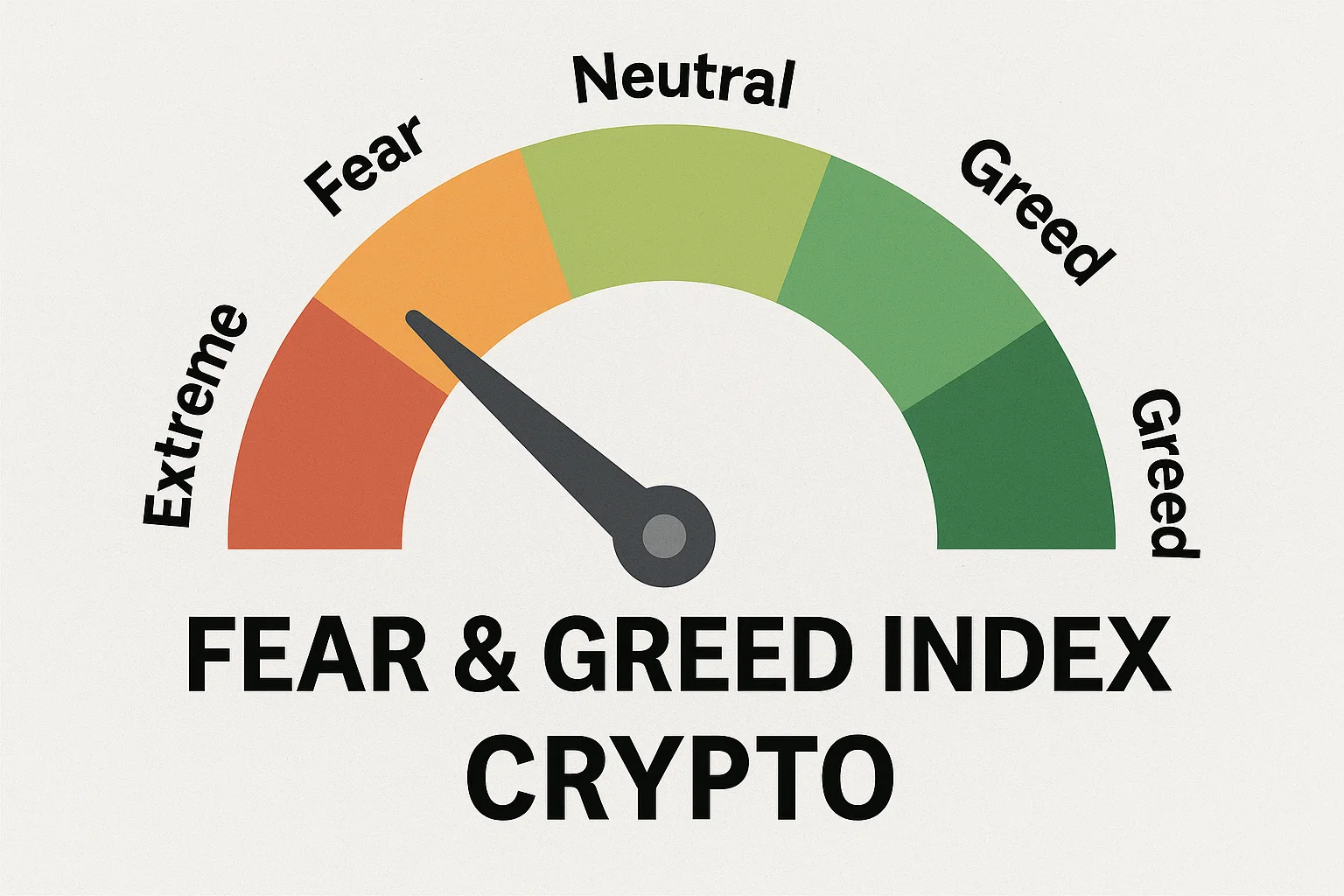

Fear and Greed Index in crypto is one of the most underrated sentiment tools in a trader’s arsenal. It condenses overall market emotion into a single number — revealing whether investors are fearful, greedy, or neutral.

At bit2050.com, we explain how this index works, where to find it, and how you can use it to your advantage in 2025’s volatile crypto markets.

This index measures market sentiment on a scale from 0 (Extreme Fear) to 100 (Extreme Greed) by analyzing:

Volatility

Market momentum

Social media sentiment

Surveys

Dominance of Bitcoin

Google Trends

Trading volume

It’s updated daily and mostly tracks Bitcoin, though it’s increasingly used for altcoin sentiment too.

Markets are crashing. Retail investors are panic selling.

✅ Smart traders look for buying opportunities here.

Uncertainty dominates. Often occurs in sideways or correction phases.

✅ DCA or wait for reversal confirmation.

Balance between buyers and sellers.

✅ Not ideal for big moves — stay cautious.

Markets are bullish. Retail is jumping in.

⚠️ FOMO is growing. Be selective with entries.

Parabolic rallies. High social media hype.

⚠️ Often signals a top. Great time to start taking profits.

If the index stays in “Greed” but prices stall or dip — it could signal a correction.

Combine the Fear and Greed Index in crypto with technical indicators like RSI for more accurate signals.

A: Yes, it’s a great contrarian indicator when combined with technical or on-chain analysis.

A: Visit alternative.me, the most popular source.

A: While focused on Bitcoin, it reflects general crypto sentiment and can guide altcoin trades.

A: Historically, yes. “Be greedy when others are fearful” — but always combine with your own research.

A: It reflects sentiment, not price. Use it to time entries/exits, not as a standalone predictor.

The Fear and Greed Index in crypto is like reading the emotional pulse of the market. Extreme fear creates buying opportunities, while extreme greed warns of pullbacks. Smart traders track it daily for strategic decision-making.

For more psychological and data-driven trading insights, visit bit2050.com — your guide to mastering crypto markets in 2025.