Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

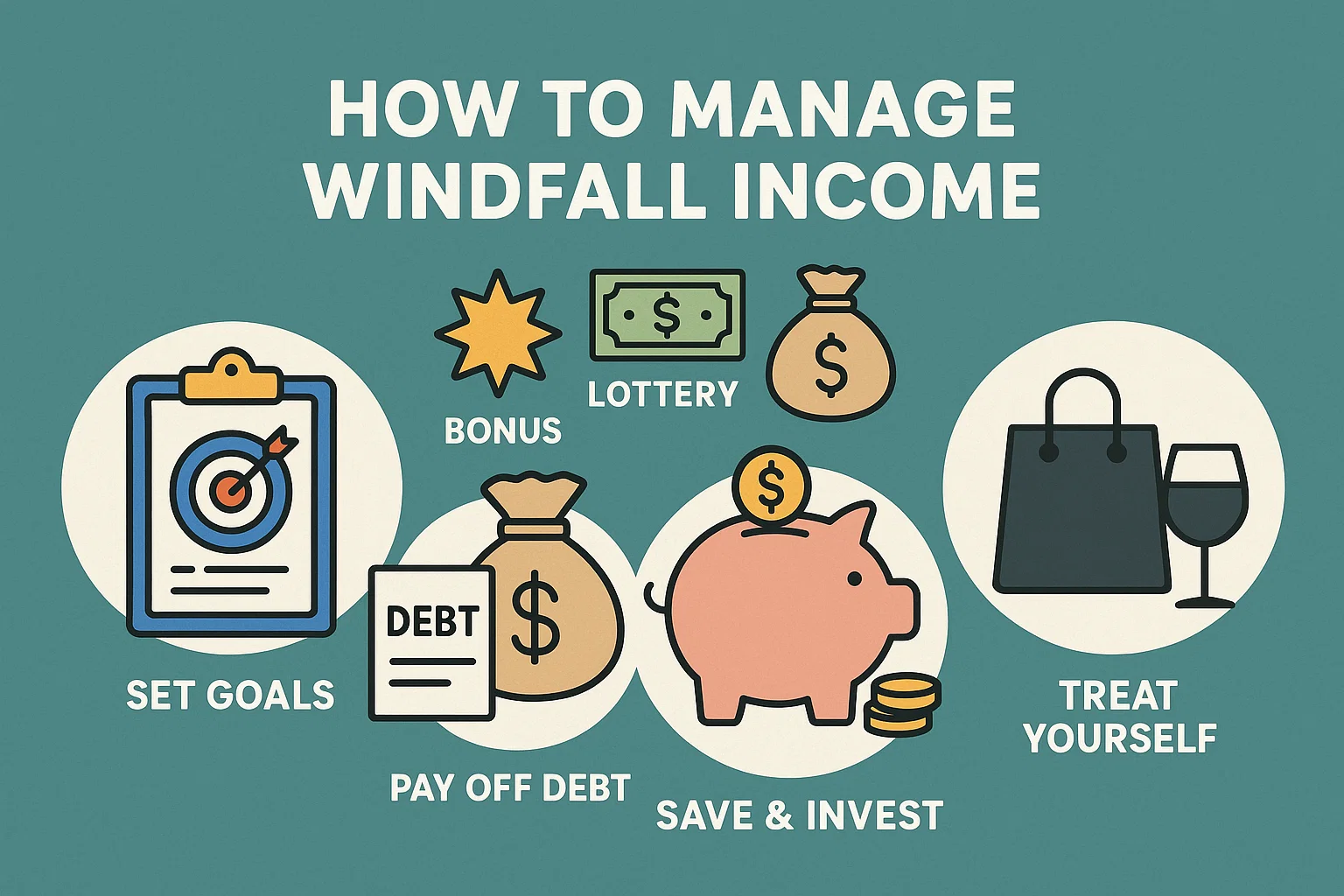

Receiving a windfall — whether it’s a yearly bonus, inheritance, or lottery win — can feel thrilling. But if not handled wisely, easy money can disappear fast.

Here’s a step-by-step guide on how to manage windfall income in 2025 like a financially savvy pro.

Don’t make decisions in the first 72 hours. Let the emotion settle before touching the money.

Why? Emotional spending is the fastest way to lose windfalls.

Temporarily move the money to:

Liquid mutual funds

High-yield savings accounts

Short-term FDs

This keeps it safe and earns a bit of interest while you plan.

Use 10–30% to clear:

Credit card debt

Personal loans

Payday loans

Less debt = more future freedom.

Ensure you have at least 6–12 months of expenses saved.

Windfalls are a rare chance to create true financial security.

Check if your windfall is taxable:

Bonuses are taxed as regular income

Lottery wins have TDS

Inheritance is not taxed in India — but gains on inherited assets may be

Consult a CA before making investments.

Don’t keep it all in savings. Consider:

Mutual Funds (SIP + lumpsum)

Index funds or ETFs

Gold bonds or sovereign gold

Diversified crypto (if risk-tolerant)

Follow a mix of safe and high-growth strategies.

For windfalls over ₹5 lakh, consult a fee-only financial planner.

They help:

Avoid emotional errors

Optimize taxes

Design personalized wealth plans

Budget 5–10% for guilt-free joy:

Travel

Upgrade phone/laptop

Gifts for family

But resist the urge to splurge everything.

Use your windfall to buy time:

Invest in dividend-paying funds

Start a low-risk side hustle

Lease land or property

Stake crypto assets for yield

Let your windfall earn for years to come.

A: No. Use a staggered strategy like SIP or STP to reduce market risk.

A: Yes. A flat 30% tax + surcharge is deducted at source. No deductions allowed.

A: Debt mutual funds, PPF, and short-term FDs are good safe options.

A: Yes, but limit this to 10–25% of the amount unless you’re experienced. Don’t bet it all.

A: That’s great. Ensure you donate through registered NGOs for 80G tax benefits.

Windfalls are rare — but how you manage them can shape your entire financial future.

Avoid emotional mistakes. Think long-term. And if in doubt, let bit2050.com guide you through every money move you make in 2025 and beyond.