Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

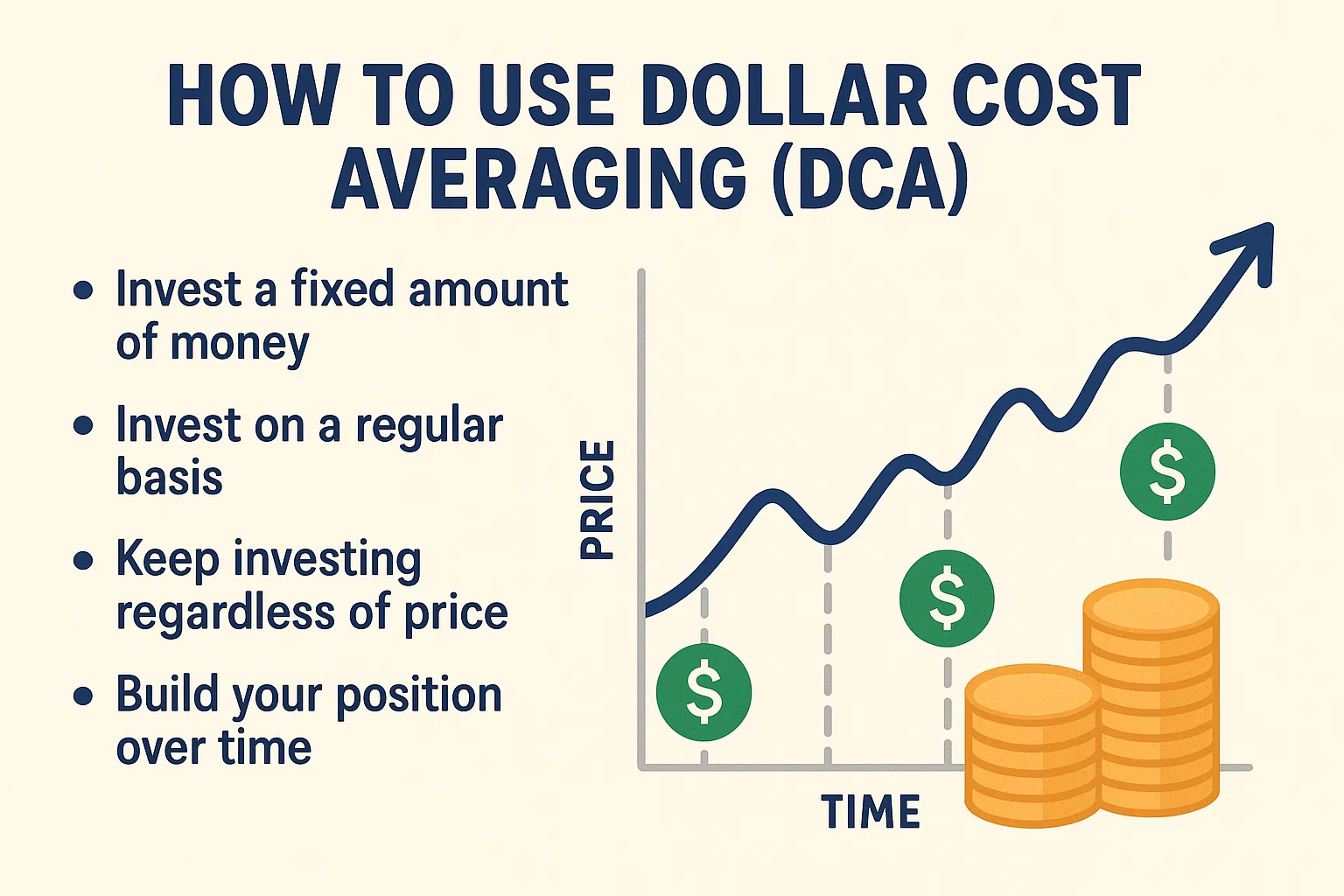

Investing in crypto can be thrilling — and terrifying. Prices swing wildly, and trying to time the perfect entry often leads to regret. That’s where Dollar Cost Averaging (DCA) comes in.

At bit2050.com, we show you how to use Dollar Cost Averaging (DCA) through 7 proven steps that can help smooth out volatility and build long-term wealth in crypto markets.

DCA is a strategy where you invest a fixed amount of money into an asset at regular intervals, regardless of its price. Over time, this reduces the impact of volatility and emotional decision-making.

You can DCA into:

Bitcoin (BTC)

Ethereum (ETH)

Top altcoins like Solana (SOL), Avalanche (AVAX), or Chainlink (LINK)

✅ Focus on high-conviction assets with strong fundamentals.

You can DCA:

Daily

Weekly

Bi-weekly

Monthly

✅ Example: Buy ₹2,000 worth of Bitcoin every Monday, no matter the price.

Consistency is key. Your DCA budget should be:

Affordable

Sustainable

Not emotionally stressful

✅ Even ₹500/week adds up to ₹26,000/year.

Use platforms that allow auto-DCA like:

Binance

CoinDCX

WazirX

ZebPay

Or use crypto bots with Coinrule or 3Commas

✅ Automation removes emotion and overthinking from your trades.

As you accumulate crypto, your average cost per unit becomes more stable.

✅ Example: Buy BTC at ₹25K, ₹28K, ₹30K, and ₹27K = Average = ₹27.5K

Use spreadsheets or tools like:

Koinly

CoinStats

Delta App

DCA is all about long-term vision. Don’t panic if the market dips.

✅ Volatility becomes an opportunity — you buy more units when prices drop.

The best gains often come after prolonged accumulation during bear markets.

✅ Discipline during dips often leads to big returns during the next bull run.

A: Yes. DCA reduces the risk of buying at the wrong time and builds disciplined investing habits.

A: Yes, if the asset consistently trends down. But DCA limits losses compared to lump-sum investing during market highs.

A: Bitcoin and Ethereum are top choices due to market dominance and long-term adoption.

A: Yes. Many investors DCA into a basket of 3–5 cryptos for diversification.

A: Ideally, at least 6–12 months or longer. DCA works best over extended timeframes.

Learning how to use Dollar Cost Averaging (DCA) can be a game-changer for crypto investors. It removes emotion, reduces risk, and helps you build wealth consistently.

At bit2050.com, we believe in disciplined investing over chasing hype. Stick with your plan, stay patient, and let compounding work its magic.