Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

Have you ever bought something just to feel better — and regretted it later?

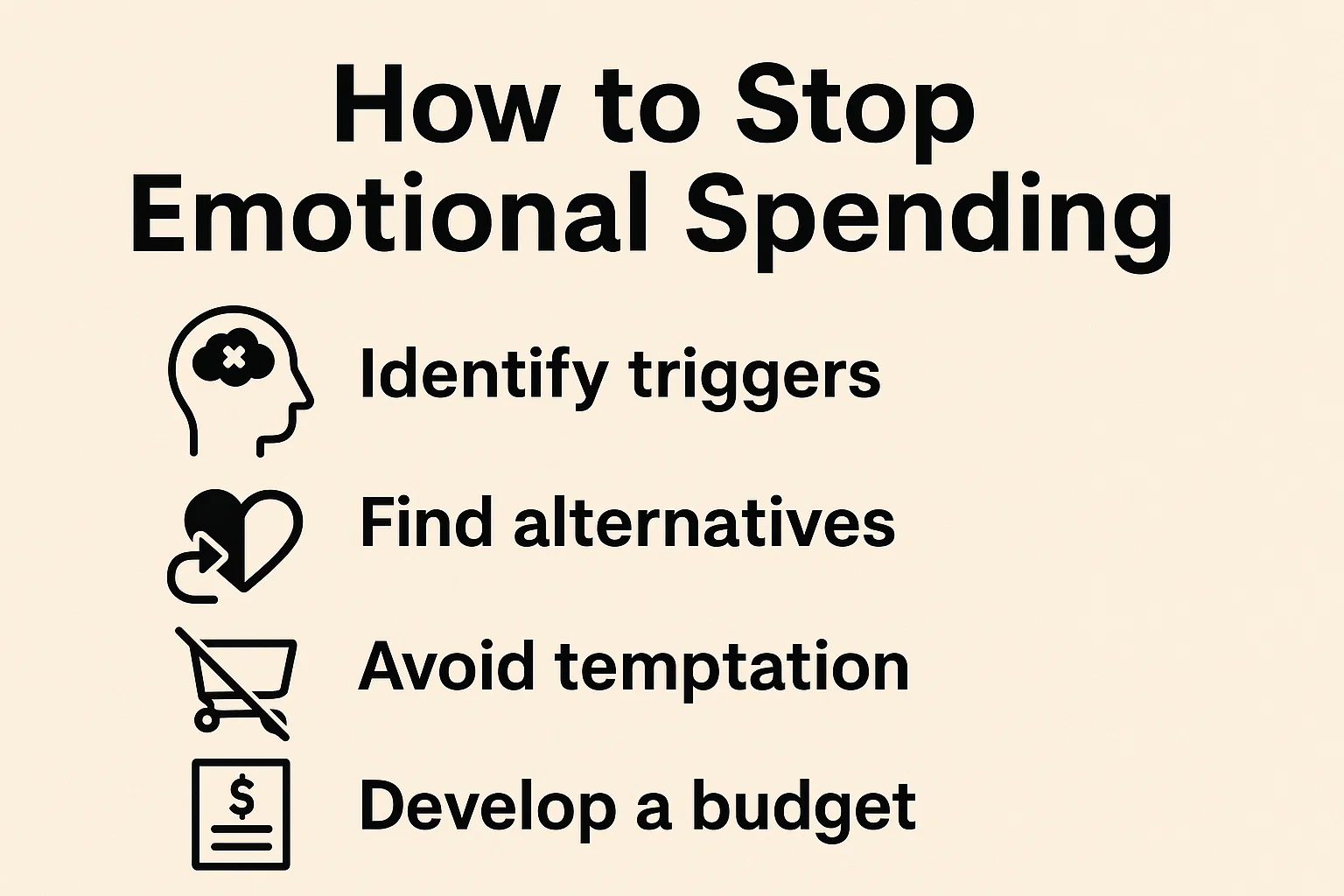

Emotional spending is more common than you think, especially in times of stress, boredom, or sadness. But the good news is: you can learn how to stop emotional spending with a few smart strategies.

Let’s break down exactly how to regain control of your money and emotions.

Keep a spending journal to identify emotional patterns:

Are you buying when sad, bored, or anxious?

Do you overspend after arguments or stressful days?

Knowing the trigger is the first step to changing the habit.

Use the “24-Hour Rule” before buying anything non-essential.

This delay helps separate emotions from decisions.

Having solid money goals helps redirect emotional energy into motivation:

Save ₹1 lakh in 12 months

Clear debt in 6 months

Invest ₹5,000/month in SIPs

Unfollow online stores, unsubscribe from email promos, and delete shopping apps. Out of sight = out of impulse.

Give yourself a “fun spending” category (5–10%).

This way you enjoy life without guilt and without overspending.

Pause and ask:

“Do I really need this?”

“What emotion am I trying to fix right now?”

“Will this matter in 24 hours?”

Studies show people spend less when using cash over cards.

Try switching to cash for discretionary expenses.

Talk to a friend, partner, or even a finance coach who can support your no-spend goals.

Instead of shopping, try:

Going for a walk

Calling a friend

Journaling or meditating

Listening to music or podcasts

It’s when you buy things to cope with emotions like sadness, boredom, or stress — rather than genuine need.

Yes. The goal is mindful shopping, not total restriction. Include a small, guilt-free budget for fun.

Sometimes. Chronic emotional spending may indicate stress, anxiety, or even depression, and talking to a therapist could help.

You may start seeing change in 2–4 weeks with consistent effort, journaling, and goal-setting.

Yes. Try Mint, ET Money, or You Need a Budget (YNAB) to log expenses and mood notes.

Learning how to stop emotional spending is one of the most powerful financial habits you can develop. It not only saves you money but also helps build emotional resilience.

Start with one small step today — and trust that with consistency, change will follow.

For more money tips that help you stay in control, visit bit2050.com.