Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

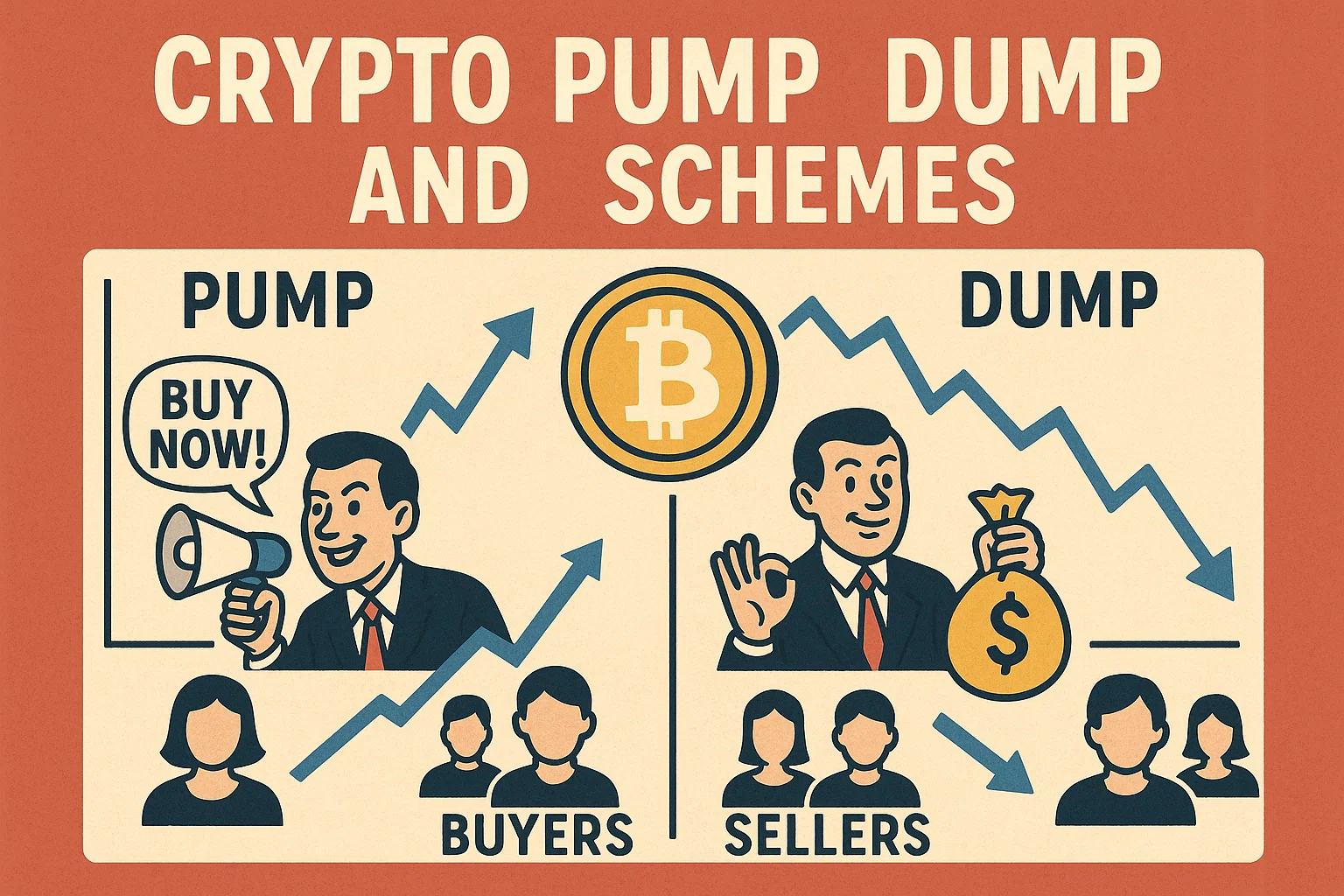

Crypto pump and dump schemes have flooded the market, especially in low-cap tokens and meme coins. These manipulative practices lure retail investors with false hype—only to crash the price after insiders sell.

At bit2050.com, we explain how these scams work, the warning signs, and how to stay safe in 2025’s fast-paced crypto world.

A pump and dump in crypto involves artificially inflating a coin’s price (“pump”) through coordinated hype—often via Telegram or Twitter—then suddenly selling off (“dump”), leaving late buyers with heavy losses.

Organizers buy a low-liquidity coin cheaply

Create online hype (FOMO)

Push price up fast

Sell at peak

Price crashes, retail traders lose money

If a coin jumps 300%+ within minutes, especially with no news—be cautious.

Telegram groups, X (Twitter) threads, or TikTok pushing a coin you’ve never heard of = 🚩.

Scam coins usually show very little trading activity, then explode due to insider coordination.

If there’s no website, whitepaper, or use case—it’s likely a shell coin made just to manipulate.

New influencers with fake followers or paid promotions often take part in pump groups.

Coins that keep bouncing between small exchanges or have been delisted elsewhere = major red flag.

Use blockchain explorers to see if a few wallets hold huge amounts—this often signals a trap.

A: No. Some are real, based on news. But if there’s no real reason, be cautious.

A: In most countries, yes. Coordinating such schemes is considered market manipulation.

A: Rarely. They’re more common on DEXs or small centralized exchanges with low liquidity.

A: Don’t chase green candles. Avoid meme tokens with no utility and do your own research.

A: Fines, bans, and criminal prosecution—depending on jurisdiction.

Crypto pump and dump schemes are designed to steal your money while pretending to offer fast gains. Protect yourself with proper research, risk management, and a healthy level of skepticism.

Stay informed with real, verified crypto education at bit2050.com — your trusted source for smart investing in 2025.