Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

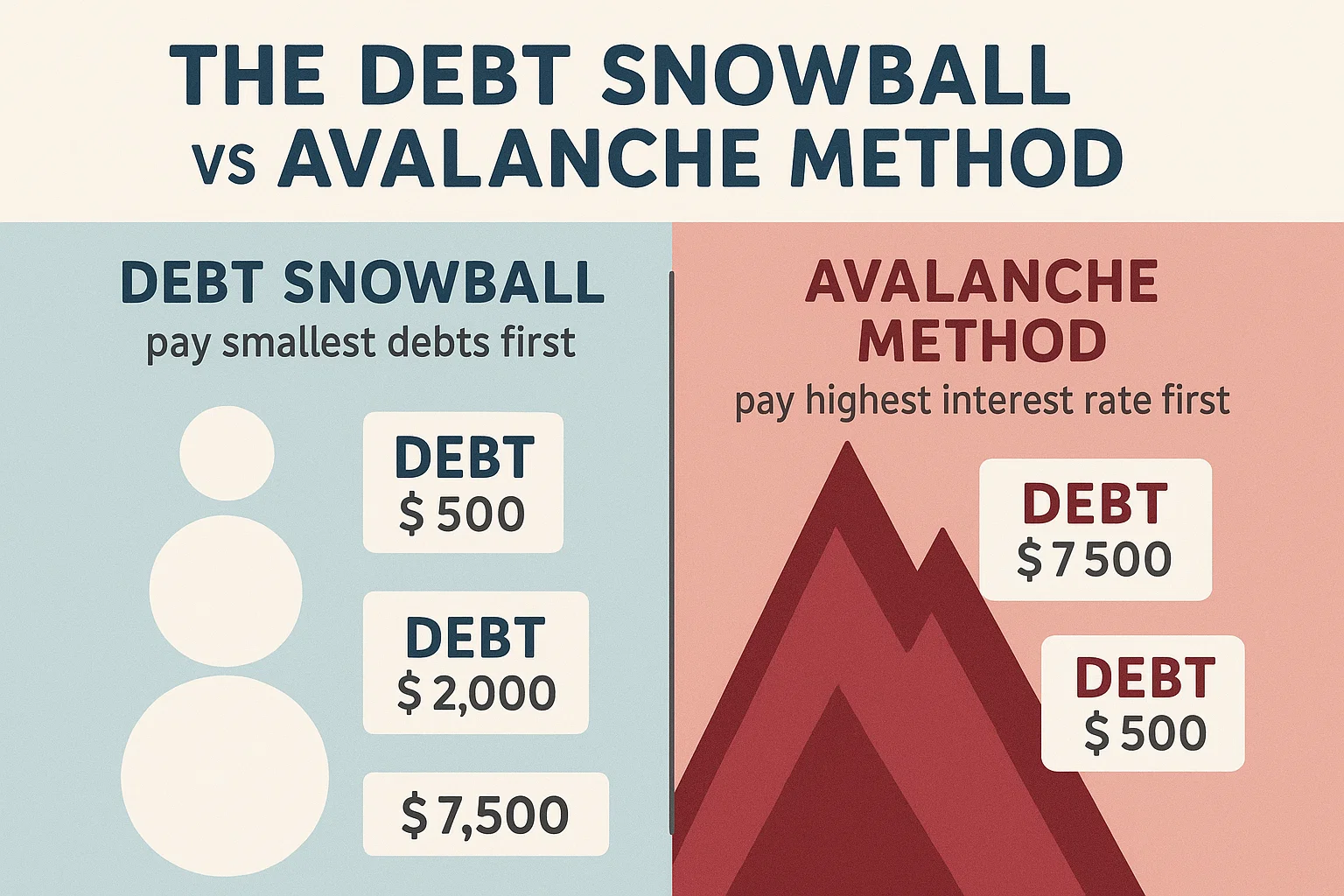

Debt snowball vs avalanche method: When it comes to paying off debt, there are two strategies that dominate the personal finance world: the Debt Snowball and the Debt Avalanche. Both work — but they work differently.

So which method is right for you? This guide breaks down the Debt Snowball vs Avalanche method, comparing pros, cons, and ideal use cases, so you can make the smartest financial move today.

The Debt Snowball Method focuses on paying off your smallest debts first, regardless of interest rate. Once a small debt is cleared, you “roll” that payment into the next smallest debt — like a snowball gaining size and speed.

₹5,000 credit card ➡️ First

₹10,000 personal loan ➡️ Next

₹30,000 car EMI ➡️ Last

You gain emotional wins early, building motivation to keep going.

The Debt Avalanche Method tackles your highest interest rate debt first, saving you the most money in the long run.

36% credit card ➡️ First

18% personal loan ➡️ Next

10% car loan ➡️ Last

This approach is mathematically optimal, reducing total interest paid.

| Criteria | Snowball Method | Avalanche Method |

|---|---|---|

| Focus | Smallest balance first | Highest interest first |

| Speed of motivation | Fast (quick wins) | Slower, but logical |

| Total interest saved | Less savings | More savings |

| Ideal for | Emotional motivation | Mathematically minded |

| Ease of use | Very easy to follow | Slightly more complex |

The Avalanche method is usually faster in total time and money saved, but only if you stay motivated.

The Snowball method is beginner-friendly and ideal if you need emotional wins to stay on track.

Yes! Some people use a hybrid method — start with Snowball for quick wins, then switch to Avalanche to save more interest.

Use the Avalanche method if interest is high. If it’s low-interest and long-term, consider investing alongside slow repayment.

Yes. Try Goodbudget, YNAB, or India-based apps like ET Money and Walnut.

Choosing between the debt snowball vs avalanche method depends on your personality, income, and what motivates you more — fast results or long-term savings.

💡 No matter which path you choose, consistency is key. Ready to destroy debt and build wealth?

👉 Visit bit2050.com for more tools, guides, and real-money advice.