Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

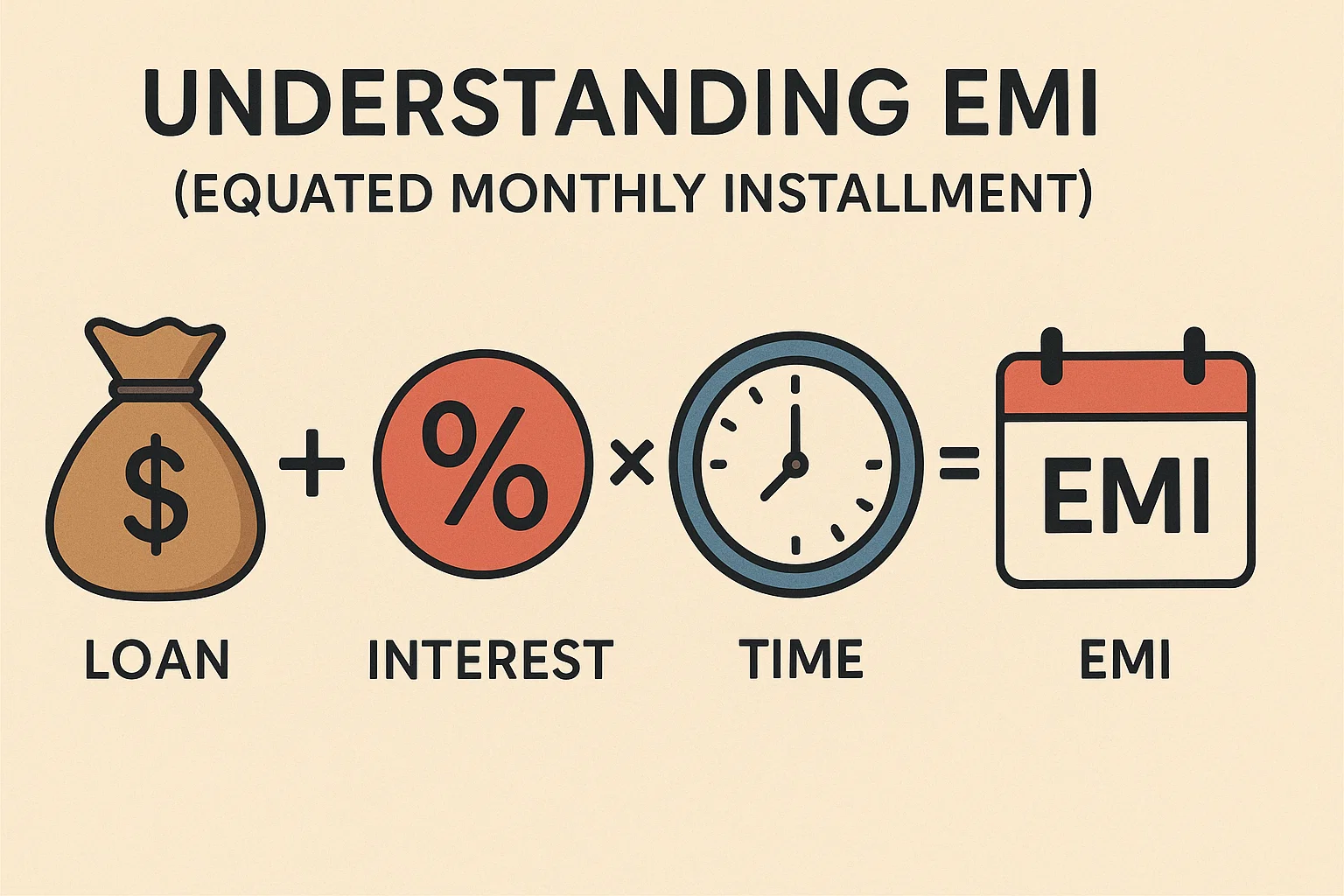

Understanding EMI : EMI stands for Equated Monthly Installment, a fixed payment amount made by a borrower to a lender at a specified date each month. It includes both principal and interest components and is widely used in loans, such as:

Home loans

Personal loans

Auto loans

Education loans

Consumer durable loans (like phones, laptops)

The goal of understanding EMI is to make sure your loan fits comfortably within your monthly budget.

📊 Helps you budget your monthly income

🚫 Avoids loan defaults and late penalties

💸 Helps compare different loan options

💡 Prevents hidden costs from affecting you later

The standard formula to calculate EMI is:

EMI = [P × R × (1+R)^N] / [(1+R)^N – 1]

Where:

P = Loan amount (Principal)

R = Monthly interest rate (Annual Rate ÷ 12 ÷ 100)

N = Number of months

💡 Use an online EMI calculator for convenience.

Longer tenure = Lower EMI but higher total interest

Shorter tenure = Higher EMI but lower interest paid

Better credit = Lower EMI

Poor credit = Higher EMI or even loan rejection

Home loans may have floating interest rates, which can change the EMI mid-way.

Paying a lump sum early can lower your future EMIs or reduce your loan tenure.

Missing an EMI damages your credit history and can increase future interest rates.

Most lenders require NACH or standing instruction for automatic EMI deduction.

Some banks allow flexibility to pick your EMI deduction date—use this to align with your salary cycle.

Yes, if you refinance your loan or make a partial prepayment, your EMI may change.

Shorter tenures are better for saving interest, but go for longer ones if you want affordability.

Late fees are charged and your credit score is negatively impacted.

Yes. It’s called prepayment, and it reduces your principal amount.

Yes. Each EMI includes both interest and principal unless specified otherwise (like no-cost EMI offers).

Understanding EMI is essential for anyone considering a loan. It ensures you make informed decisions, stay financially stress-free, and protect your credit score.

For more practical finance insights and tools, visit 👉 bit2050.com – your trusted guide for smarter money and crypto moves.