Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

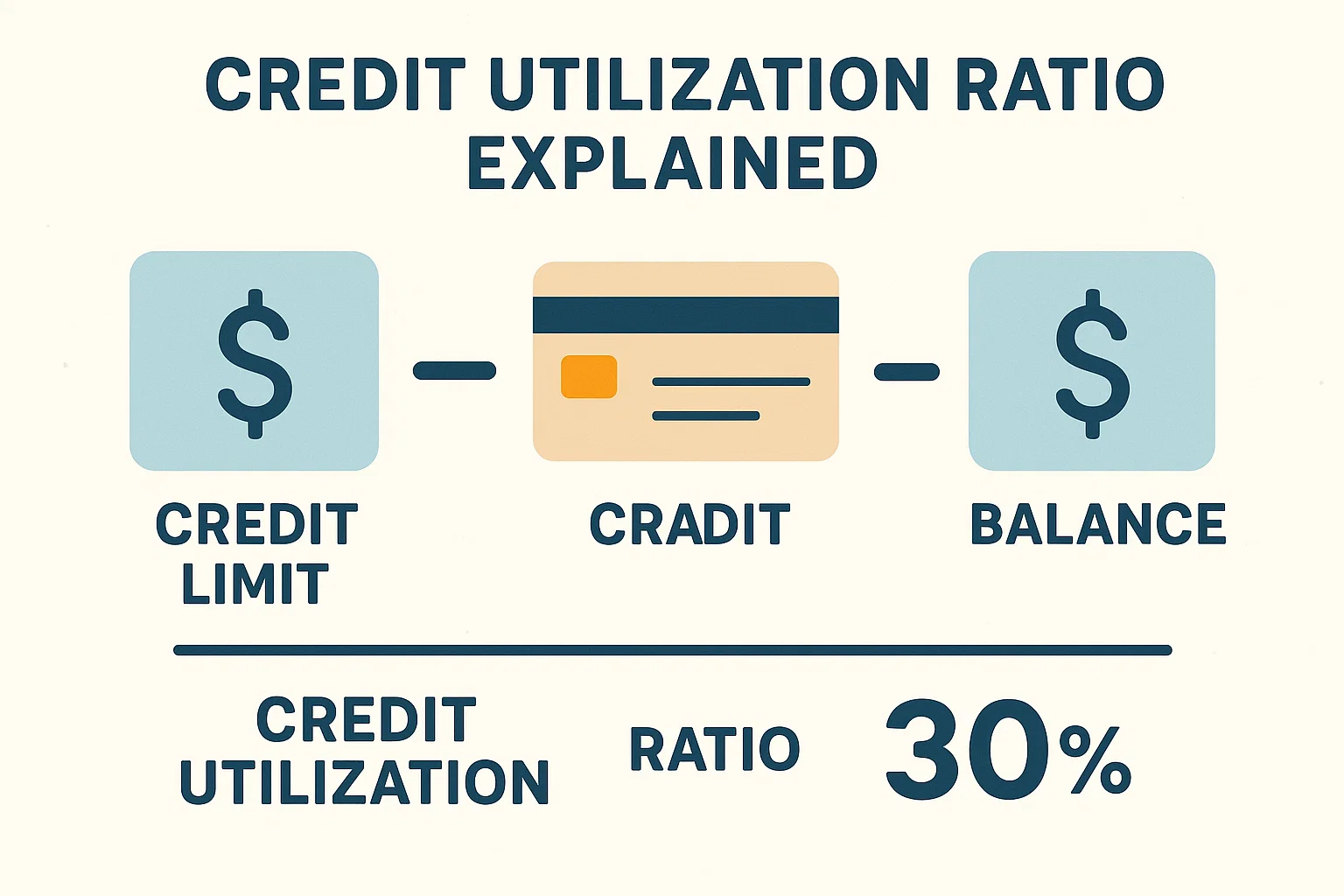

The credit utilization ratio is one of the most important yet overlooked factors in your credit health. It represents the percentage of your available credit you’re currently using. Lenders use this ratio to determine how responsibly you manage credit. A lower ratio usually signals better credit behavior.

Direct Impact on Credit Score:

It contributes up to 30% of your credit score calculation. Keeping it low helps maintain a high score.

Risk Assessment for Lenders:

High utilization = high risk. Lenders may view you as financially overextended.

Loan Approval Chances:

A low ratio boosts approval rates for loans and credit cards.

Better Interest Rates:

Responsible usage can lead to more favorable loan and credit terms.

Use this simple formula:

Credit Utilization (%) = (Total Credit Used ÷ Total Credit Limit) × 100

Example:

If you’ve used ₹20,000 on a ₹1,00,000 total credit limit, your utilization ratio is 20%.

Experts recommend keeping your utilization below 30%, and under 10% for top-tier credit scores.

Pay off credit cards before the due date

Ask for a higher credit limit (without increasing spending)

Spread expenses across multiple cards

Make multiple payments in a month

Avoid closing old credit cards

Maxing out credit cards, even if paid on time

Only checking the ratio at statement closing

Ignoring the impact of supplementary cards

Q1. Is credit utilization calculated monthly?

Yes, it’s usually reported by lenders monthly to credit bureaus.

Q2. Does zero credit utilization hurt your score?

Not necessarily, but some usage is better than none for maintaining active credit behavior.

Q3. Should I increase my credit limit?

Yes, if you can control your spending, it can help lower your utilization ratio.