Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

Credit cards can be powerful financial tools — or dangerous traps. The difference lies in how you use them. In 2025, as credit becomes more accessible in India and worldwide, credit card usage errors are increasingly common, and costly.

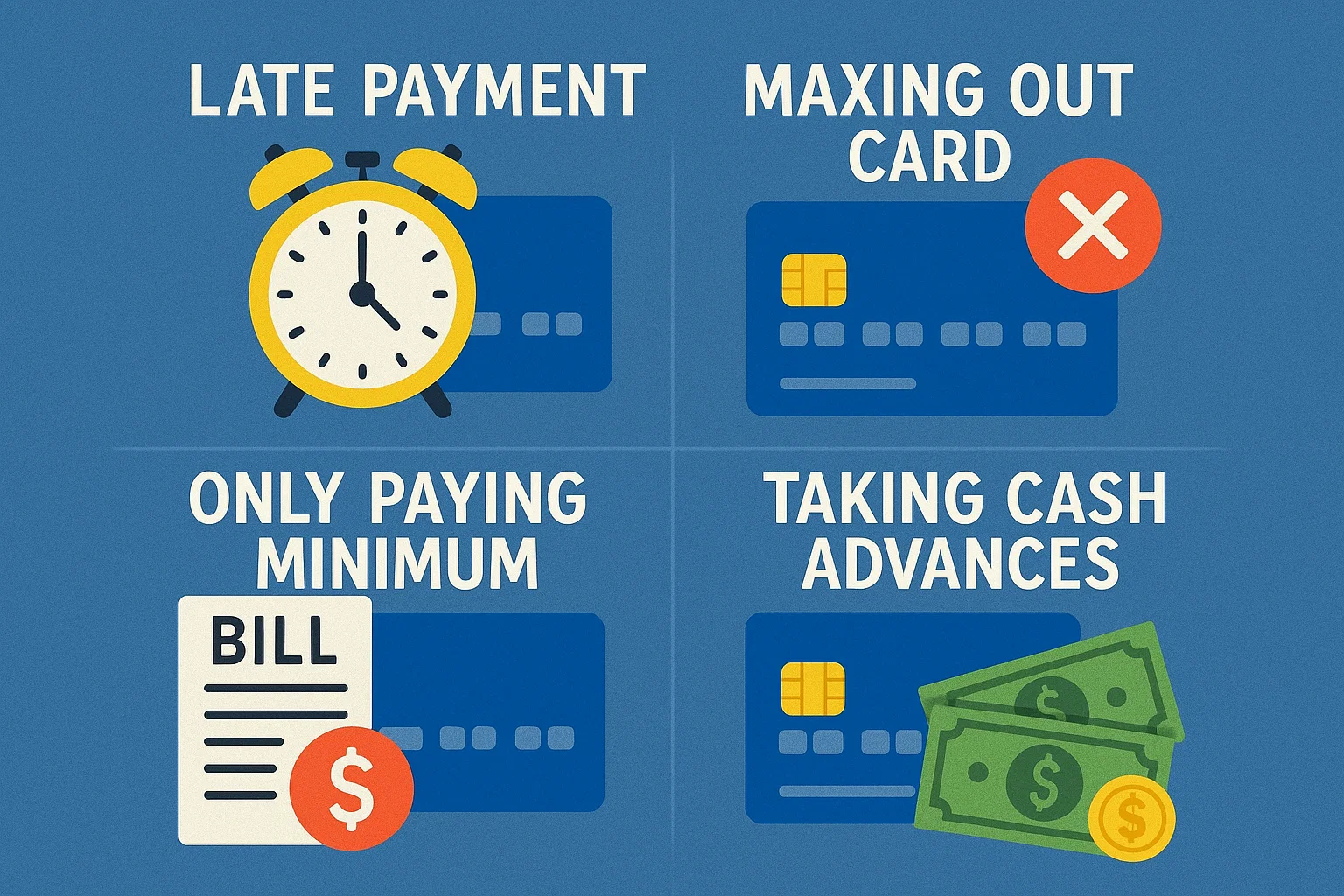

Here are the top 7 mistakes you must steer clear of to protect your wallet and your credit health.

Paying just the minimum amount keeps your account in good standing — but it’s a trap. Interest compounds on the remaining balance, leading to massive debt over time.

Using over 30% of your credit limit can negatively affect your credit score. High utilization signals risk to lenders, even if you pay on time.

🧠 Pro Tip: Keep your usage below 30% — ideally under 10% — of your total credit limit.

This one’s obvious but critical. Even one missed payment can impact your credit score for up to 7 years and result in late fees or penalty interest rates.

Each credit card application triggers a hard inquiry, which lowers your score slightly. Too many inquiries in a short time makes you look credit-hungry.

Many people forget to redeem their credit card points before they expire. Unused points are wasted money — stay on top of reward deadlines!

Using your card to withdraw cash leads to instant interest charges and cash advance fees, with no grace period.

Skimming your bill isn’t enough. You could miss unauthorized charges, annual fee increases, or billing errors.

Keep it under 30% of your limit for best credit score results. Below 10% is even better.

Only if it’s a temporary emergency. Paying the minimum leads to high interest accumulation.

Ideally 2–3 cards, used responsibly, are enough to build a strong credit profile.

Yes, especially if it’s an old card with a high credit limit. Always consider the impact on your credit age and utilization ratio.

Check your monthly statements regularly. Set up transaction alerts via SMS and email for real-time tracking.

Smart credit card usage isn’t just about spending — it’s about building financial health. By avoiding these common traps, you not only safeguard your money but also build a strong credit score, setting yourself up for financial success.

Explore more personal finance tips at 👉 bit2050.com