Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

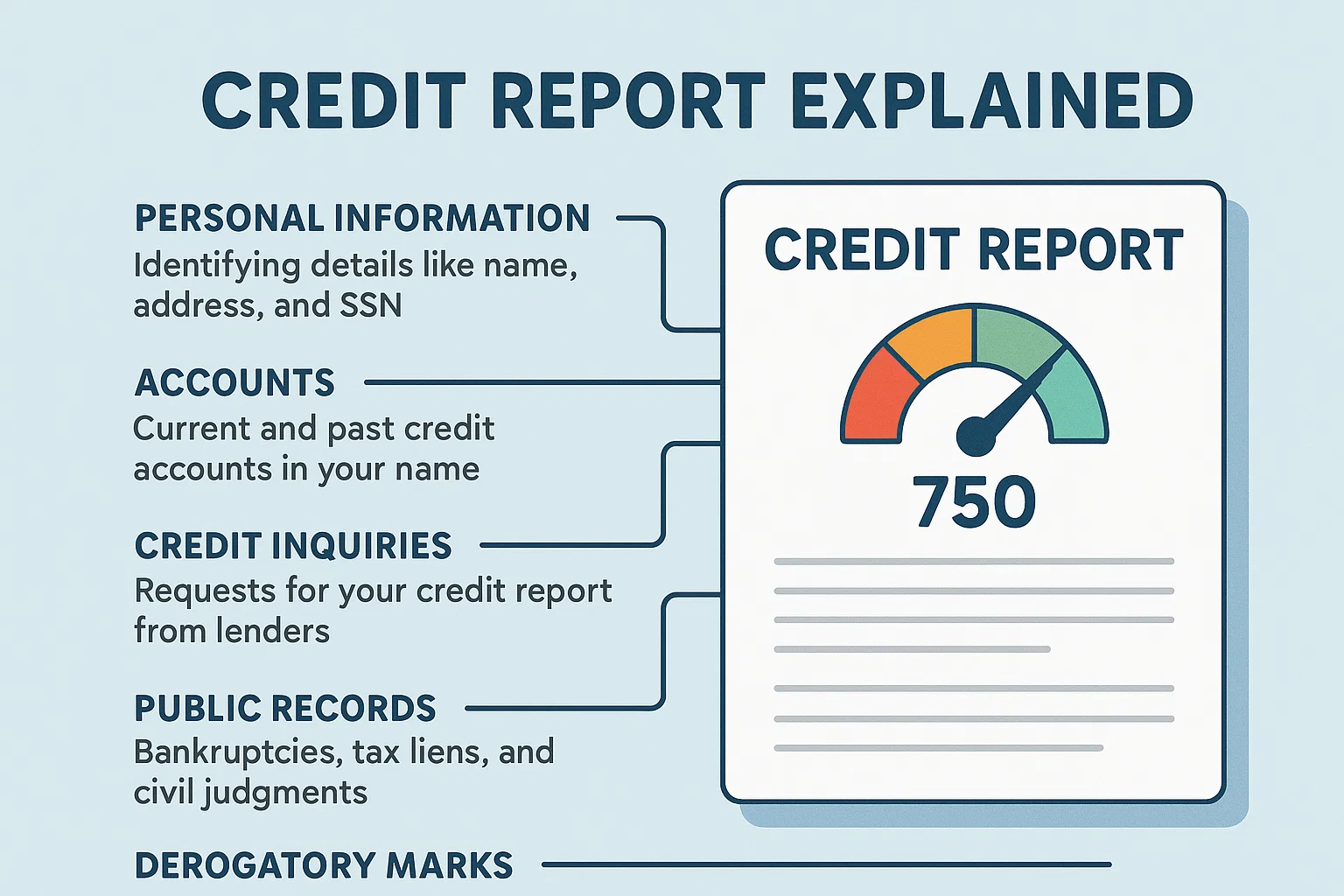

Credit report explained : Your credit report is a detailed summary of your credit history. It shows how you’ve managed loans, credit cards, and repayments. Lenders use it to determine your creditworthiness.

In India, major credit bureaus include:

CIBIL

Equifax

Experian

CRIF High Mark

🎯 Loan Approvals – Banks check your credit report before approving any credit.

💰 Interest Rates – A good report = lower interest rates.

📉 Credit Score Insights – It influences your CIBIL score (300–900 scale).

🛡️ Fraud Detection – It helps catch identity theft or unauthorized accounts.

🏦 Credit Card Eligibility – Higher score unlocks premium credit cards.

Here’s what your report typically includes:

| Section | Details |

|---|---|

| Personal Info | Name, PAN, Date of Birth, Contact info |

| Credit Accounts | Credit cards, loans (open and closed) |

| Payment History | Timely/late payments, defaults |

| Credit Inquiries | Who accessed your report (hard/soft checks) |

| Credit Score | CIBIL score or equivalent (range: 300–900) |

Check for Errors: Wrong PAN, name, or account info.

Review Payment History: Look for missed or late payments.

Check Utilization Ratio: Using 30% or less of your limit is ideal.

Look at Credit Mix: Having both secured and unsecured loans is healthy.

Watch Inquiry Frequency: Too many recent loan applications = risky behavior.

Always pay on time

Avoid maxing out your credit cards

Don’t close your oldest credit account

Limit new loan applications

Dispute errors directly with the credit bureau

At least once a year. You can get one free report per year from each bureau in India.

No. Self-checks are soft inquiries and don’t impact your credit score.

Yes, raise a dispute with the bureau, and they usually resolve it in 30 days.

A score of 750 or higher is considered excellent for getting loans at good rates.

Some companies may check your credit history for roles involving financial responsibility.

Understanding your credit report is essential in 2025. It’s not just a record — it’s your financial identity. Stay informed, review it regularly, and take action to build a strong credit profile.

For more such smart financial guides, visit 👉 bit2050.com