Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

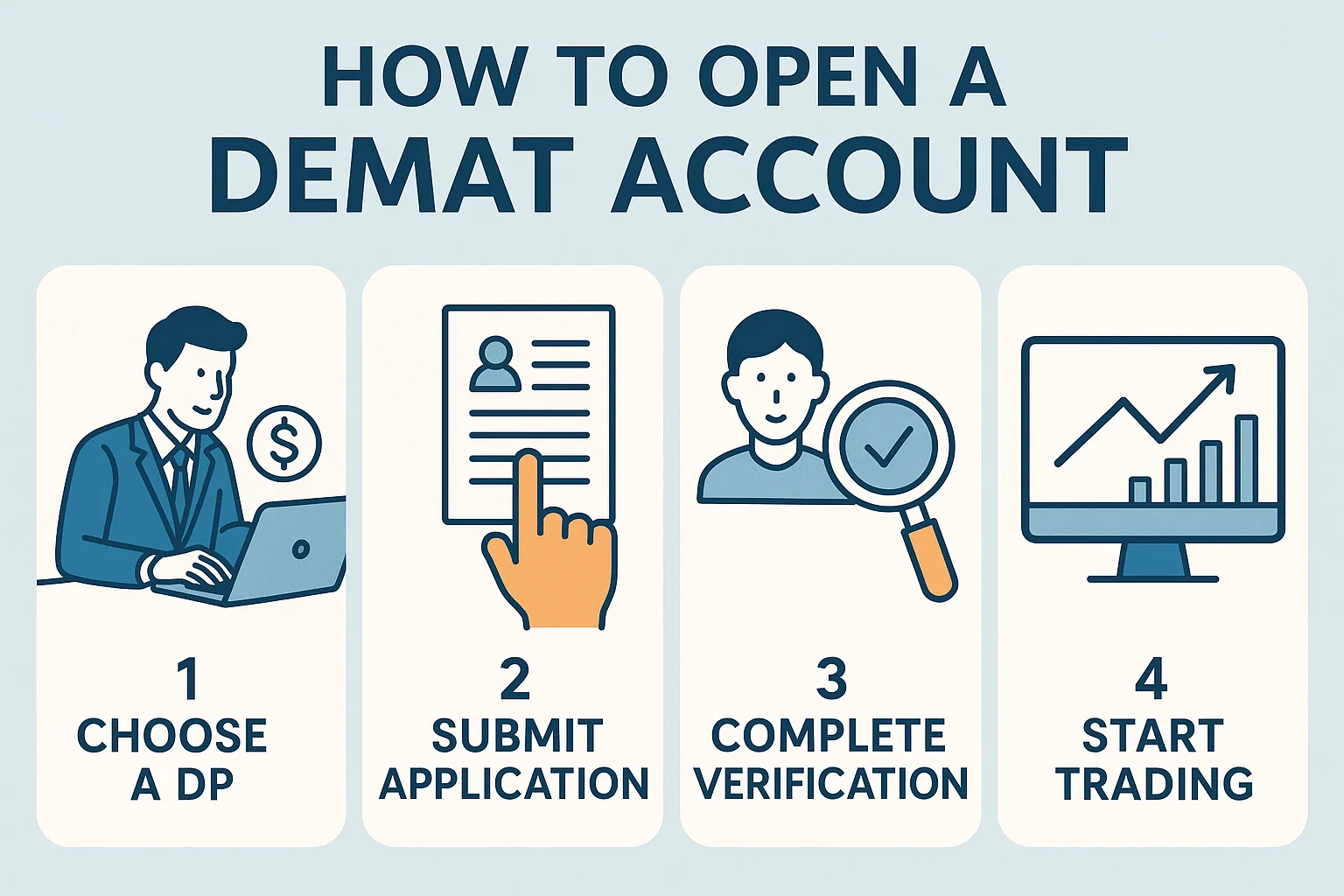

How to open a demat account : A Demat account (short for Dematerialized Account) is an electronic account where your stocks and securities are stored digitally. It eliminates the need for physical share certificates and is mandatory to trade in the Indian stock market.

A Depository Participant is an agent of NSDL or CDSL (India’s two main depositories). Choose a trusted broker like:

Zerodha

Groww

Angel One

Upstox

ICICI Direct

Go to your chosen DP’s website and:

Click on “Open Demat Account”

Enter basic details: name, PAN, mobile number, and email

Verify via OTP

You’ll need:

PAN card (mandatory)

Aadhaar card

A passport-size photo

A canceled cheque or bank statement

✅ Most platforms use Aadhaar-based eKYC for paperless registration.

Some platforms require you to:

Record a short video (via webcam or phone)

Show PAN & Aadhaar card live

Use your Aadhaar-linked mobile number to e-sign via OTP authentication.

Once verified, you’ll receive:

Demat Account Number (16-digit for CDSL / 8-digit for NSDL)

Trading Account login credentials

You’re now ready to buy/sell shares on the stock market!

Most brokers offer zero account opening charges but may charge annual maintenance fees (AMC).

Yes, but only one per broker. You can hold multiple accounts with different DPs.

For e-KYC, yes. If you don’t have Aadhaar, you’ll need to follow the offline process.

Usually within 24–48 hours if you complete online e-KYC properly.

Both are central depositories.

NSDL is linked with NSE

CDSL is linked with BSE

Your broker decides which one your Demat account will be with.

Opening a Demat account in 2025 is now faster and easier than ever. Whether you’re new to investing or switching brokers, following these steps will help you open and activate your account smoothly.

🚀 Ready to start your investment journey? Visit bit2050.com for more guides like this.