Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

When it comes to building long-term wealth, choosing the right stocks or mutual funds is not enough. The real power lies in how you divide your money across asset classes—this is called asset allocation.

In this article on bit2050.com, we break down the importance of asset allocation, how it affects your returns and risk, and why it’s a non-negotiable part of every smart investor’s toolkit.

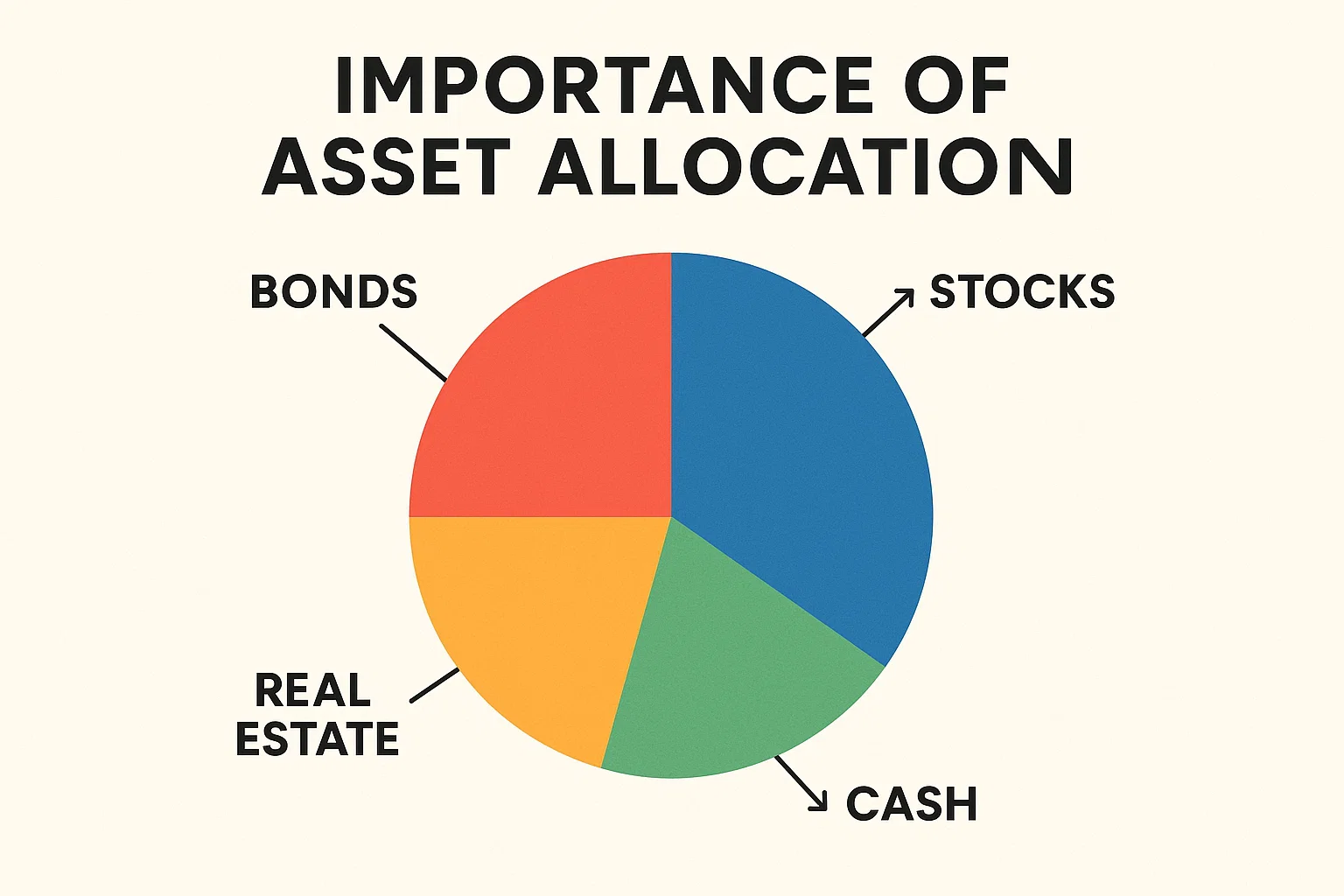

Asset allocation is the process of dividing your investment portfolio among different asset classes, such as:

Equities (Stocks)

Fixed Income (Bonds, FDs)

Cash or Liquid Funds

Real Estate

Commodities (Gold, Silver)

Cryptocurrencies

The exact mix depends on your age, risk tolerance, and financial goals.

A well-diversified asset mix spreads risk. When one asset falls, another may rise—keeping your portfolio balanced and less volatile.

Studies show that asset allocation accounts for over 90% of a portfolio’s long-term performance—not stock-picking or timing the market.

As market conditions shift, your asset mix ensures you’re not overly exposed to a single sector or type of risk.

Your goals—retirement, buying a home, saving for your child’s education—each require different timeframes and asset strategies.

Diversification via asset allocation helps your portfolio weather economic downturns, inflation, or market crashes with confidence.

| Age | Equity | Debt | Others |

|---|---|---|---|

| 25 | 80% | 15% | 5% |

| 35 | 70% | 25% | 5% |

| 50 | 50% | 45% | 5% |

| 60+ | 30% | 60% | 10% |

📝 Tip: As you grow older, reduce equity and increase debt/stable assets.

👉 Ideally, once every 6 to 12 months or after major life events.

Yes, but limit exposure to 1–5%, as it’s highly volatile.

Statistically, yes. Asset allocation determines up to 90% of your investment outcome over time.

Yes. Balanced or hybrid funds automatically diversify across equity and debt.

Ignoring it! Most new investors go all-in on one asset, which increases long-term risk.

The importance of asset allocation cannot be overstated. Whether you’re investing ₹1,000 or ₹10 lakh, your success depends less on which stock you buy—and more on how you spread your money across assets.

Want more expert-backed insights? Visit bit2050.com for practical tips on building smarter portfolios in 2025 and beyond.