Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

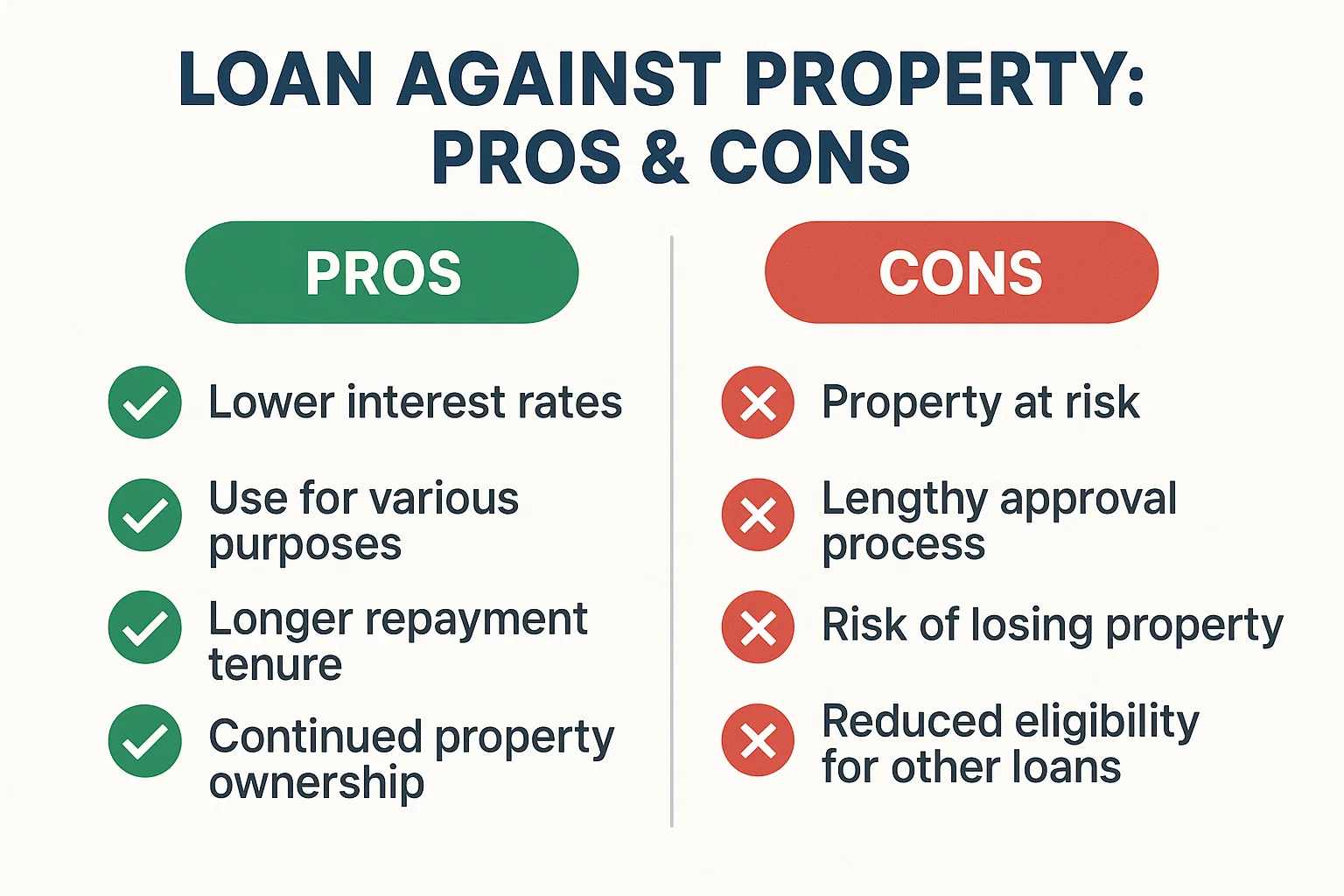

A Loan Against Property (LAP) is a secured loan where you pledge your residential, commercial, or even rented property as collateral. It’s a popular way to raise high-value funds at lower interest rates compared to unsecured loans.

But like any financial decision, it comes with both strong advantages and serious drawbacks. Here’s a complete breakdown to help you make an informed choice.

LAP interest rates typically range between 9%–12%, which is much lower than personal loans (which go up to 16–24%).

You can get up to 60–75% of your property’s current market value — ideal for business expansion, weddings, or education abroad.

Loan terms can go up to 15–20 years, making EMIs more affordable and easier to manage over time.

No restrictions on end-use — whether it’s business, medical expenses, or debt consolidation.

You retain ownership and use of the property during the loan term, unless you default.

A LAP adds diversity to your credit profile, boosting your credit score if paid on time.

You may get tax deductions if the loan is used for business purposes or for house renovation (under Section 24(b)).

If you fail to repay, the lender has the right to auction the property.

Since it’s a secured loan, documentation and property valuation can take 1–3 weeks.

Due to the long processing time, it’s not suitable for urgent or small funding requirements.

Any disputes or unclear titles can delay or reject your application.

If you opt for deferred EMIs, interest continues to accumulate, increasing the final cost.

✅ Need ₹10+ lakhs at low interest

✅ Have a clear-titled property

✅ Can repay over 10–15 years

✅ Want funds for business, not personal luxuries

Yes, if you’re the legal owner, rented commercial/residential properties can be pledged.

Yes, most banks require a CIBIL score of 700+ for faster approval and better interest rates.

Yes. But some banks may charge a prepayment penalty. Check the loan terms before applying.

Property papers (ownership proof)

Income documents (ITR, salary slips)

ID/address proof

No-objection certificate (in case of co-owners)

If you need large funds and have property, LAP is usually cheaper and longer-term than a personal loan.

A loan against property is a powerful financial tool — if used wisely. It’s ideal for planned, large-scale expenses but risky if you cannot maintain timely repayments. Always compare offers, read the fine print, and calculate your repayment ability.

Want help comparing loan offers? Bookmark 👉 bit2050.com for expert guides, tools, and crypto-finance insights.