Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

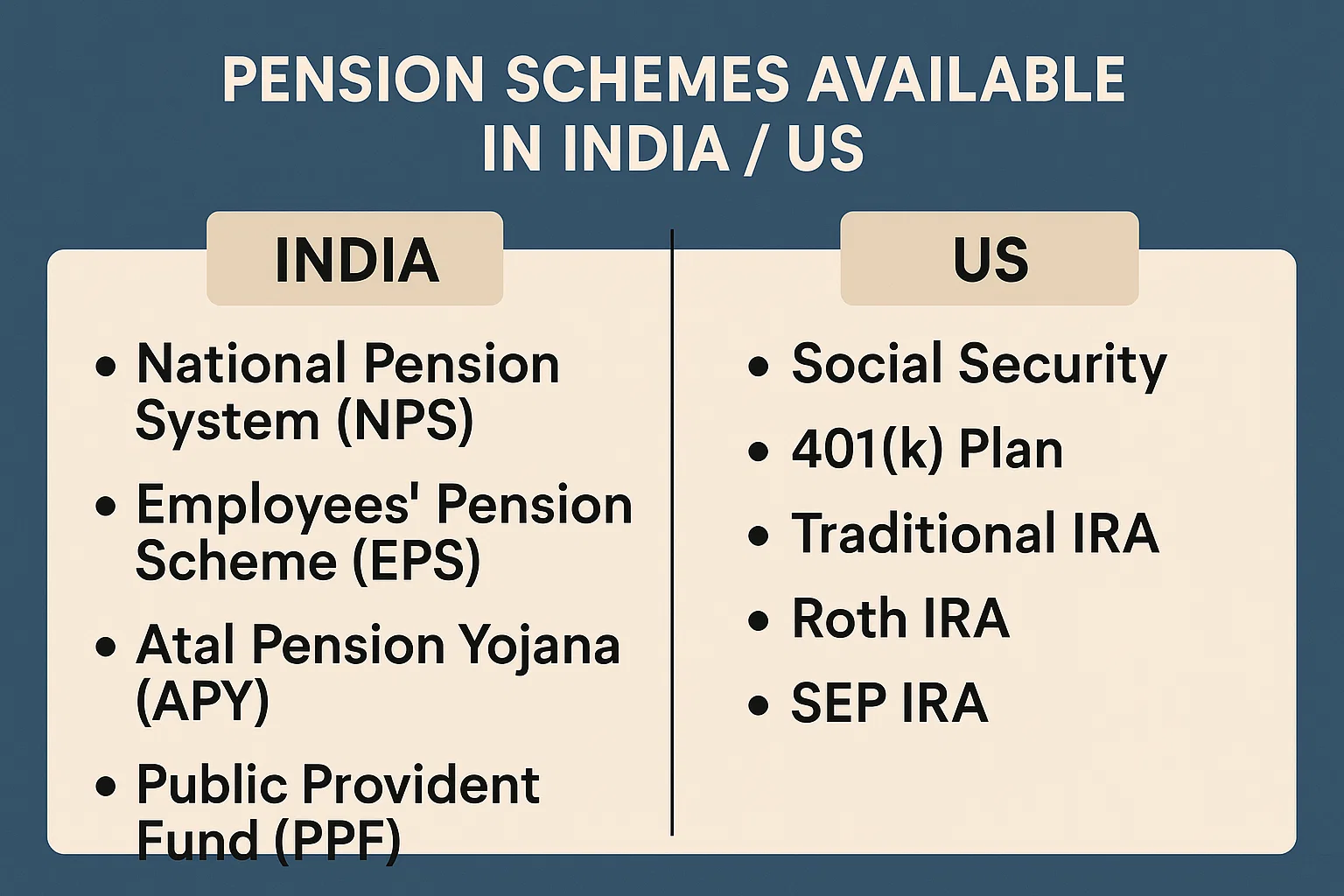

National Pension System (NPS)

A government-backed voluntary retirement savings scheme.

Offers market-linked returns and tax benefits under Section 80C & 80CCD.

Atal Pension Yojana (APY)

Designed for workers in the unorganized sector.

Provides a guaranteed monthly pension of ₹1,000–₹5,000.

Employee Provident Fund (EPF)

Mandatory for salaried employees in the organized sector.

Contributions by employee & employer, with interest earned on the corpus.

Public Provident Fund (PPF)

Long-term savings instrument with a 15-year lock-in.

Offers tax-free interest and principal under EEE (Exempt-Exempt-Exempt) status.

Senior Citizens Savings Scheme (SCSS)

Specifically for individuals above 60 years.

Offers regular quarterly income with higher interest rates.

Mutual Fund-Based Retirement Plans

Not government-regulated but allow flexible investing.

Best for higher returns with medium to high risk.

LIC Jeevan Akshay VII

Annuity-based pension plan from LIC.

One-time premium payment, lifelong pension thereafter.

Social Security

A federal benefit program for retirees above 62.

Monthly payouts based on work history and age of retirement.

401(k) Plans

Employer-sponsored retirement plans with tax-deferred growth.

Optional Roth 401(k) for post-tax contributions.

IRA (Individual Retirement Account)

Available to individuals to save independently for retirement.

Traditional IRA (tax-deferred) vs. Roth IRA (tax-free withdrawals).

Pension Plans (Defined Benefit)

Employer-funded, now less common.

Guaranteed monthly payout after retirement.

Thrift Savings Plan (TSP)

Similar to 401(k), but for federal employees and military personnel.

SEP IRA

Simplified Employee Pension for self-employed professionals.

Annuities

Insurance contracts that offer regular payouts during retirement.

As populations age and inflation rises, choosing the right pension scheme is crucial to secure financial freedom in retirement. Whether you’re in India or the US, understanding these plans helps avoid dependency and promotes long-term stability.

For salaried employees, EPF and NPS are ideal. For self-employed, PPF and LIC plans work well.

Yes, NRIs can invest in NPS and PPF with some restrictions.

You can start at 62, but full benefits are available at 67 (based on year of birth).

Yes, traditional 401(k) contributions reduce your taxable income.

Yes, but contribution limits apply separately.