Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

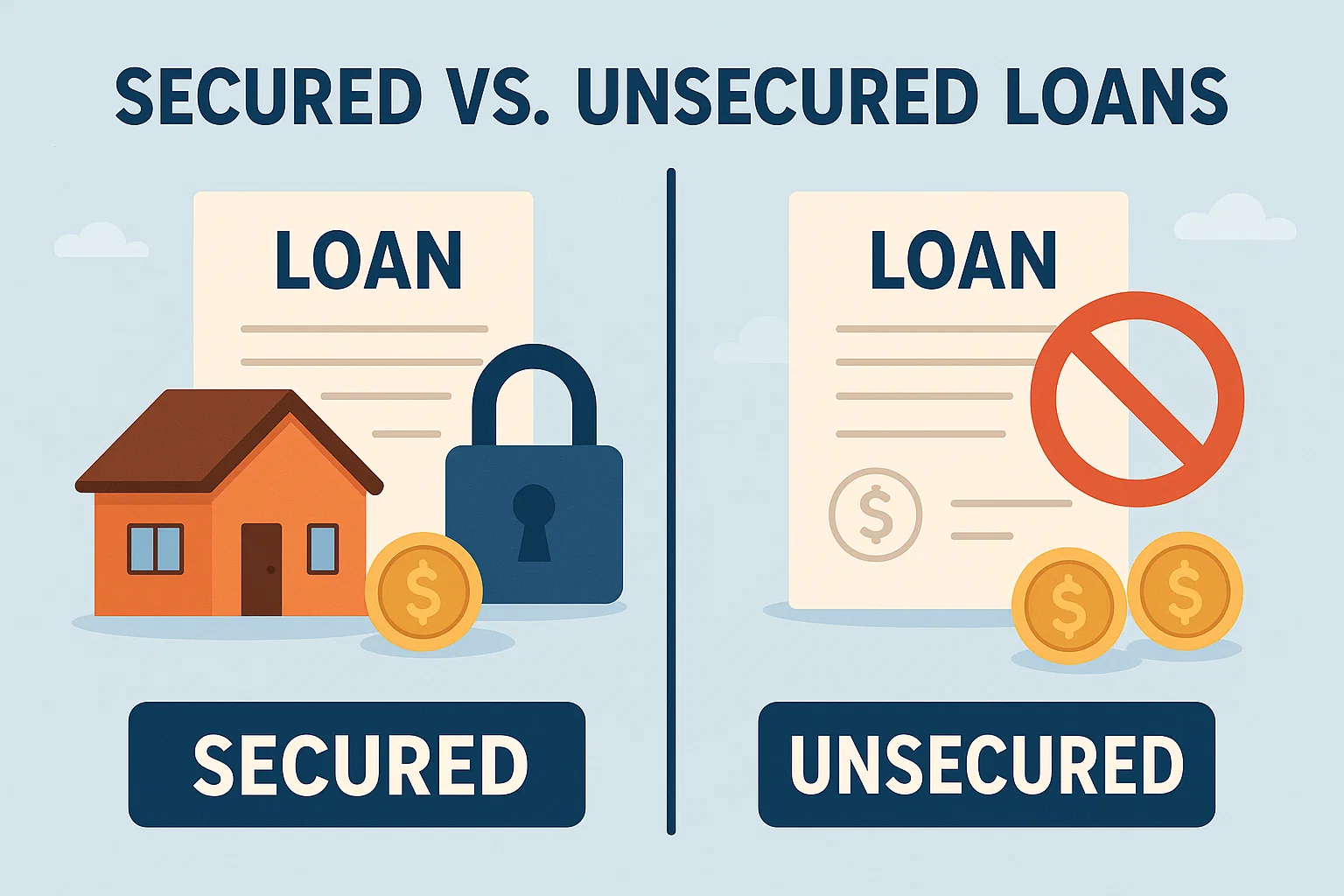

When you’re borrowing money, one question matters most: Is it a secured or unsecured loan?

Understanding secured vs unsecured loans is essential for making smart financial decisions. Let’s break it down.

A secured loan is backed by collateral — something valuable like a car, house, or fixed deposit. If you fail to repay, the lender can seize the asset.

Home Loans

Car Loans

Loan Against Property

Gold Loans

An unsecured loan is not backed by collateral. Lenders approve based on your credit score, income, and repayment history.

Personal Loans

Credit Cards

Student Loans

Consumer Durable Loans

| Feature | Secured Loans | Unsecured Loans |

|---|---|---|

| Collateral | Required | Not Required |

| Interest Rates | Lower | Higher |

| Loan Amount | Higher (based on asset value) | Limited (based on credit score) |

| Risk to Borrower | Risk of losing asset | No asset at risk |

| Approval Time | Slower (valuation needed) | Faster |

| Credit Score Sensitivity | Less sensitive | Highly sensitive |

| Repayment Terms | Flexible & long-term | Shorter terms |

Pros:

Lower interest rates

Longer repayment period

Higher loan amount

Cons:

Risk of losing the collateral

Documentation can be heavy

Pros:

Fast processing

No collateral required

Ideal for small urgent needs

Cons:

High interest rates

Shorter tenure

A bad credit score = rejection

Choose Secured Loans: For big purchases like a house, business capital, or when you want better terms.

Choose Unsecured Loans: For emergencies, weddings, education, or small personal needs.

If you have collateral, secured loans are easier. Without collateral, you’ll need a strong credit score for unsecured ones.

Yes. Timely repayment improves it, but defaulting can drastically harm it and cost your asset.

Yes. All credit cards are unsecured, as they’re not backed by any collateral.

No. You must apply for a new secured loan if you want better terms or longer tenure.

Both help build credit if repaid on time. But unsecured loans are more commonly used for credit score improvements.

Choosing between secured vs unsecured loans depends on your needs, credit profile, and risk appetite. Secured loans are better for low-cost borrowing, while unsecured loans offer speed and flexibility.

For more actionable finance tips and guides, visit 👉 bit2050.com