Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

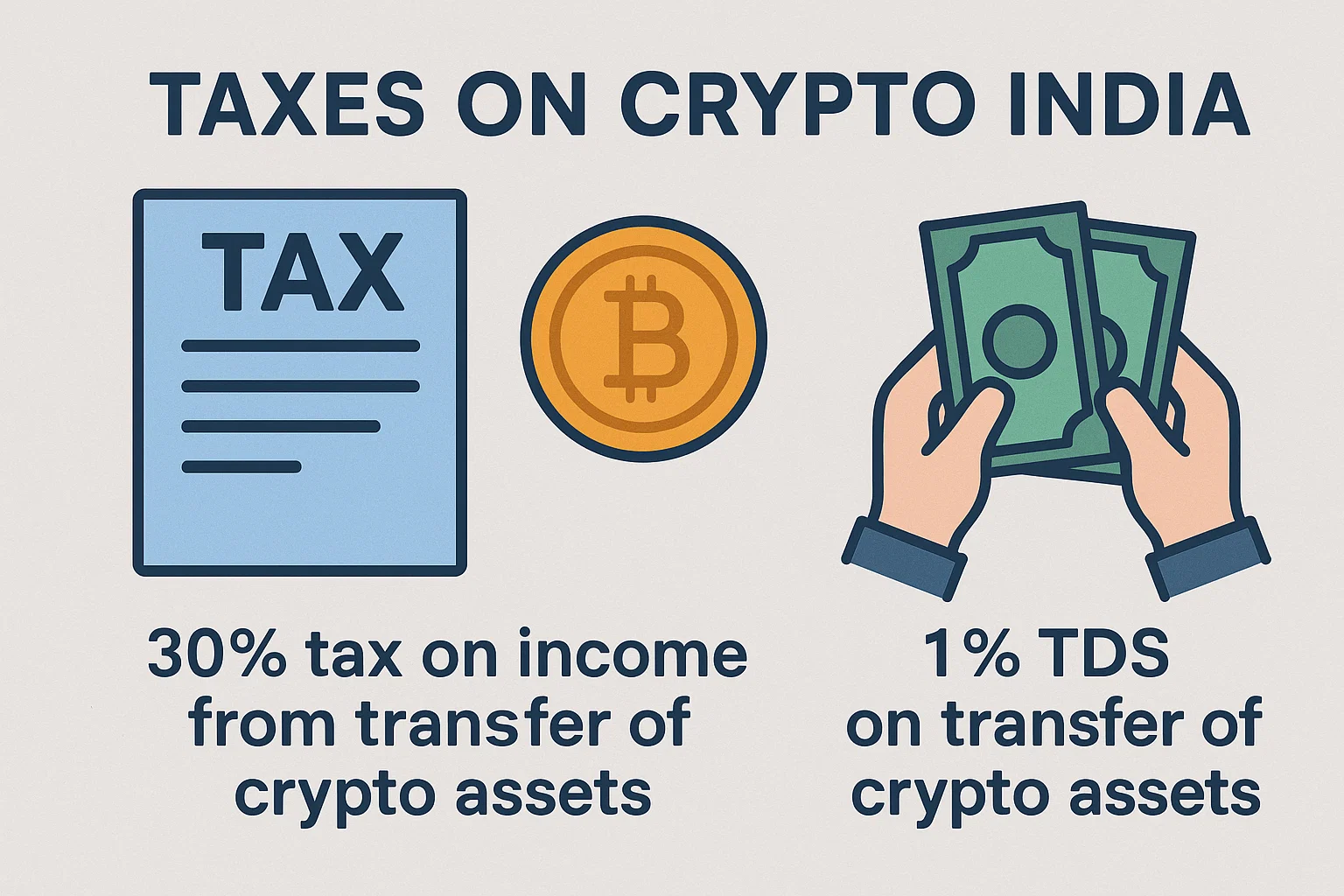

Crypto trading, DeFi, and NFTs are booming in India—but so is regulatory scrutiny. Below are the 7 essential facts about crypto taxes in India for 2025, helping you stay compliant and secure.

Crypto gains—from selling, trading, spending, or swapping—are taxed at a flat 30%, plus 4% cess and any surcharge. There is no distinction between short-term and long-term, and only the cost of acquisition is deductible.

A 1% TDS applies to every crypto transfer—on centralized exchanges, P2P platforms, even swaps—above ₹10,000 for salaried users and ₹50,000 for businesses.

Crypto losses cannot be offset against gains from other crypto or financial assets—and cannot be carried forward .

From FY 2024–25 onwards, all crypto-related activity must be reported under Schedule VDA in ITR‑2 or ITR‑3. Exchanges are required to share transaction data with the income tax department.

From 1 Feb 2025, crypto is considered “undisclosed income” under Section 158B—triggering assessments up to 6 years back, with penalties up to 60–70% on unreported crypto gains. Authorities are actively issuing notices and seizing wallets

Mining/Staking/Airdrops: taxed as “Income from Other Sources” at the individual slab rate, plus 30% on gains if tokens are later sold

Gifts over ₹50,000: taxable as income of the recipient

India aligns with the OECD’s Crypto-Asset Reporting Framework (CARF), increasing global exchange data sharing. Indian platforms must enforce KYC, TDS reporting, and transaction disclosures

A: A flat 30%, plus 4% cess and surcharge—applies to all gains without distinction .

A: Yes—a 1% TDS on every crypto transfer above ₹10,000 (salaried) or ₹50,000 (business).

You must report and submit it if trading P2P or offshore .

A: No. Crypto losses cannot be used to offset gains from crypto or other sources .

A: It ensures regulatory transparency—exchanges submit data, and failure to declare can trigger penalties or legal action .

A: Undisclosed income can lead to retroactive assessments, wallet seizures, and penalties up to 60–70% .

India’s crypto tax regime is now robust and strictly enforced. To avoid penalties or legal trouble, it’s vital to report every crypto activity, pay the flat tax, deduct TDS, and retain accurate records.

For seamless compliance and smarter tax planning, visit bit2050.com—your go-to resource for decentralized finance and digital asset guidance.