Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

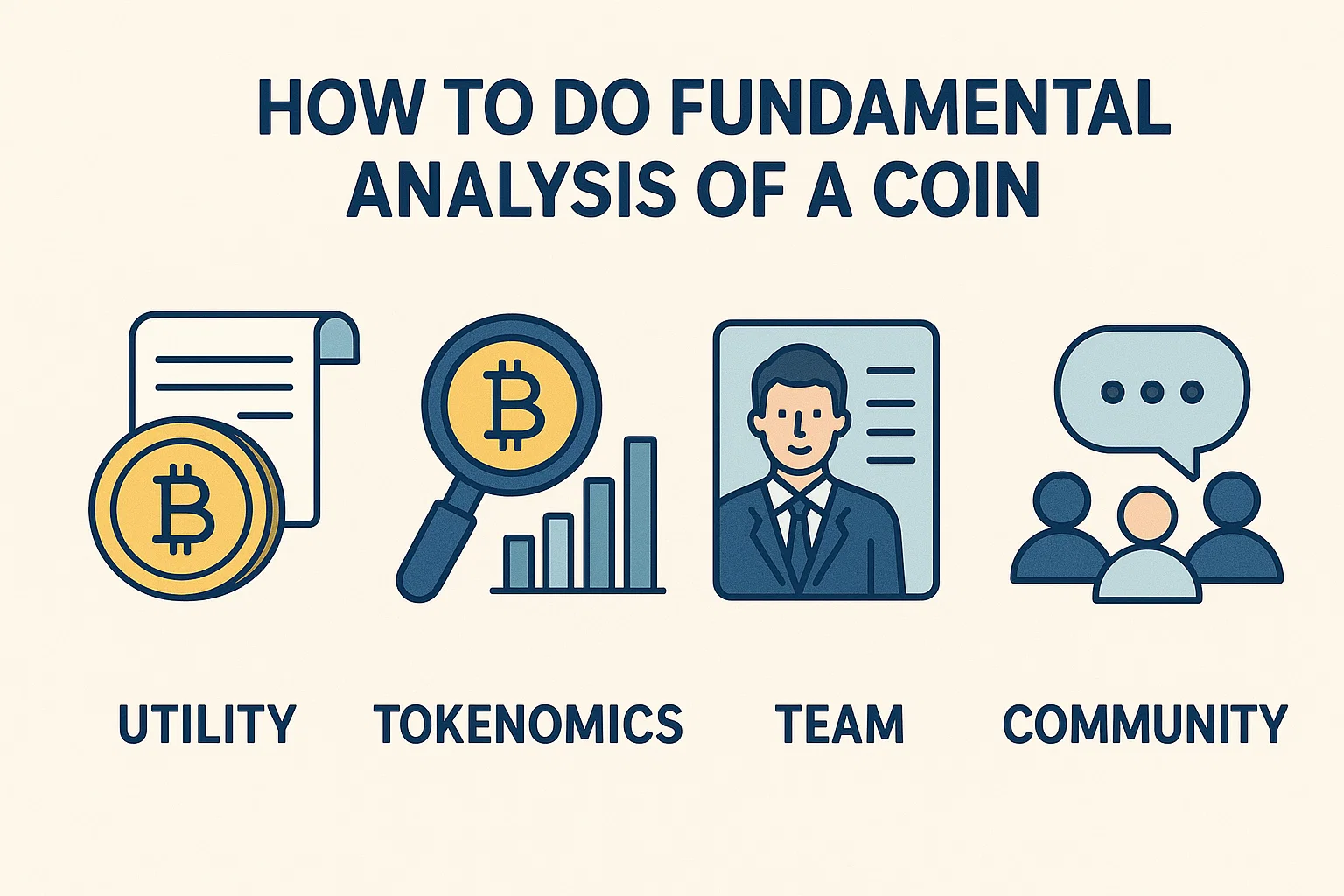

Crypto isn’t just about hype. If you want to invest wisely, knowing how to do fundamental analysis of a coin is a must. At bit2050.com, we break it down into 7 practical steps to help you separate solid projects from potential scams.

What problem does the coin solve?

Is it building infrastructure (like Ethereum)?

Is it improving scalability (like Solana)?

Or is it just another meme token?

Look for real-world application, not just hype.

Is the team doxxed and experienced?

Check:

LinkedIn profiles

GitHub activity

Past successful projects

Bonus tip: If they’ve worked in crypto before, it’s a green flag.

Every serious project has a whitepaper that explains:

Technology

Tokenomics

Roadmap

Governance

Avoid coins with vague or copy-paste whitepapers.

Max Supply

Circulating Supply

Inflation Model

Allocation (Team, Treasury, Community)

Red flags: Huge pre-mines, large dev allocations, unclear vesting periods.

Check GitHub commits, code frequency, and how active the community of builders is.

Use CryptoMiso or GitHub to verify.

No code = No development = No future.

Look into:

Active addresses

Transaction volume

Holder distribution

Liquidity on DEXs

Use tools like:

A strong project has:

Engaged community (Discord, Twitter, Telegram)

Developers building dApps on it

VC or exchange support

A project without a community is just code.

A: It’s the process of evaluating a coin’s intrinsic value using use-case, team, tokenomics, and data—not hype.

A: A combination of a real-world use case, a skilled team, and strong tokenomics.

A: Look at adoption, developer activity, and on-chain metrics—not just price movement.

A: Not always. Many scam coins use copy-paste or AI-generated whitepapers. Cross-check with development progress and community size.

A: No, but understanding GitHub activity and code updates helps gauge project seriousness.

Knowing how to do fundamental analysis of a coin is your edge in crypto investing. Don’t just chase hype—study, research, and invest smart.

For more crypto guides, tools, and expert insights, visit bit2050.com — your trusted resource for blockchain knowledge in 2025.