Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

How to do a financial detox: Ever feel like your bank account is always empty—even when your salary just came in?

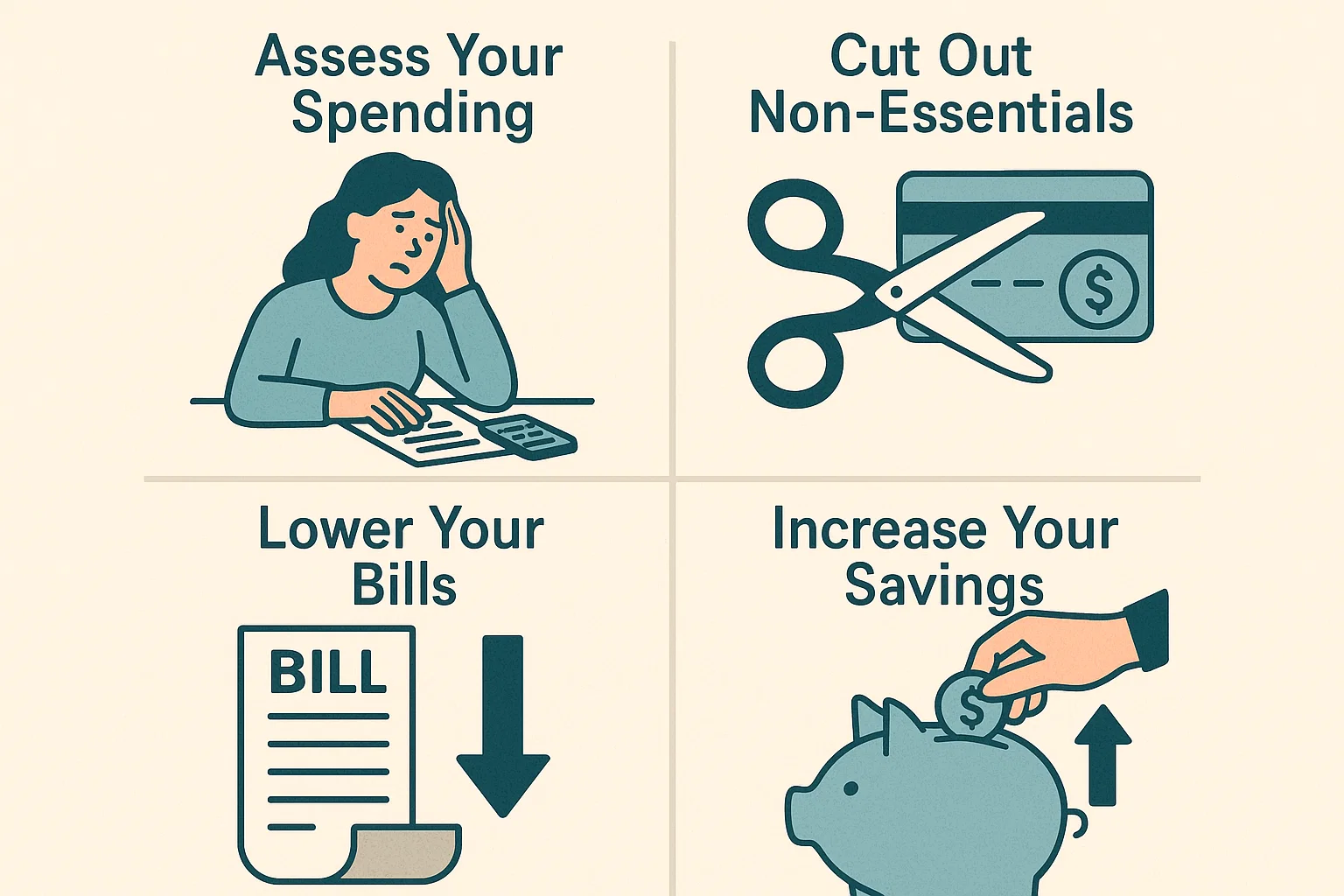

You might need a financial detox. Just like a health cleanse helps your body, a financial detox resets your relationship with money. This guide will teach you exactly how to do a financial detox and reclaim control over your spending, saving, and mindset in just 30 days.

No shopping apps, no takeout, no random subscriptions.

Ask: “Do I need this or just want it?”

Use apps like Money Manager, Walnut, or a simple Google Sheet.

You can’t change what you don’t track.

Remove:

Shopping apps (Amazon, Myntra)

Food delivery (Swiggy, Zomato)

Marketing emails

Reduce visual triggers = fewer impulse buys.

Take out a fixed amount in cash for essentials.

This helps break credit/debit card swiping habits.

Ask yourself:

Why do I spend emotionally?

What am I avoiding with retail therapy?

Reflection creates awareness.

Declutter and make money.

Sell unused gadgets, clothes, or furniture on OLX or Quikr.

Whatever you save during detox → move it to a financial goal.

Open a SIP or FD and feel the reward instantly.

| Day | Action |

|---|---|

| 1 | Unsubscribe from all promos |

| 2 | Track all spending (use an app) |

| 3 | Switch to cash spending only |

| 4 | Cook all meals at home |

| 5 | Review your bank statements |

| 6 | Sell one unused item |

| 7 | Transfer savings to SIP or RD |

A temporary reset where you cut back on non-essential expenses, track spending, and realign with your financial goals.

Start with 7 days. Extend to 30 days for a deeper reset.

Absolutely. Many people save ₹5,000–₹15,000 in just one week!

Both work—but it’s more powerful when done together. Joint reflection = stronger habits.

You’ll develop better awareness, spend more mindfully, and redirect savings toward long-term goals.

Knowing how to do a financial detox can change the way you handle money forever. It’s not just about cutting costs—it’s about cleansing your financial life for clarity, control, and calm.

Start today. Your wallet—and your peace of mind—will thank you.

Visit bit2050.com for more tools and checklists to build your financial future.