Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

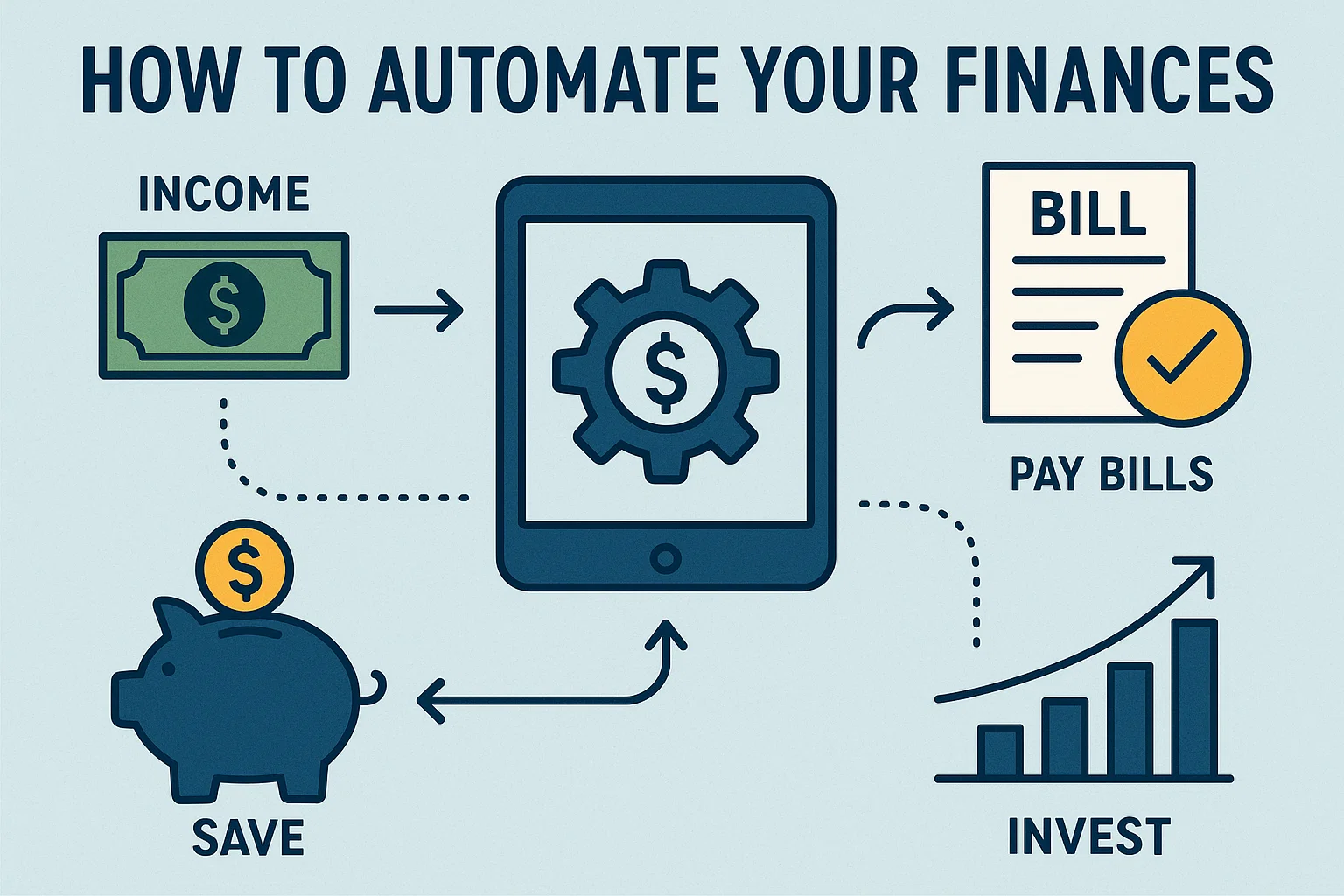

Imagine a financial system that runs smoothly in the background while you focus on your life and career. That’s the beauty of learning how to automate your finances.

Automation is one of the smartest ways to build wealth in 2025. It reduces stress, eliminates missed payments, and makes saving and investing consistent.

Let’s break down how to put your finances on autopilot — in just 7 simple steps.

Automate monthly bills like:

Rent

Internet

EMI or loan repayments

Insurance premiums

This prevents late fees and builds your credit score over time.

Follow the golden rule: Pay yourself first.

Create a recurring transfer from your salary account to your savings account right after payday.

Use sweep-in FDs or high-interest savings accounts for better returns.

Use SIP (Systematic Investment Plans) for:

Mutual Funds (Equity, Hybrid, Index Funds)

Gold ETFs

Retirement schemes like NPS

Start with ₹500–₹1,000/month and increase with income.

Avoid interest by automating:

Full payment (ideal) or

Minimum due (as backup)

Use mobile banking apps or credit card provider portals.

If a few bills can’t be automated (like school fees or annual premiums), create:

Google Calendar alerts

WhatsApp reminders for your future self

Consistency is the goal.

Apps like:

Walnut or Money View (India)

YNAB or PocketGuard (Global)

Automatically track expenses, categorize spending, and send monthly summaries.

Once your system is set up, review it:

Every 3 months

After a raise or major life change

Before tax-saving season

Automation ≠ forgetfulness. Stay in control.

Yes, if you use trusted platforms like banks, mutual fund portals, or UPI apps with secure credentials.

Yes, many landlords and billers accept auto-debit or standing instructions through banks or apps like PhonePe and Paytm.

Automate a minimum fixed amount and adjust manually when needed. Some apps also allow flexible SIPs.

Yes. Review your bank and credit statements monthly to spot errors or fraud.

Consistency. You stay on track with savings, avoid penalties, and build long-term wealth — without relying on willpower.

If you automate your Netflix subscription, why not automate your wealth-building?

Start small, start today. Automating your finances means giving your money a system — and your future, a structure. Let bit2050.com help you stay one step ahead in your money journey.