Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

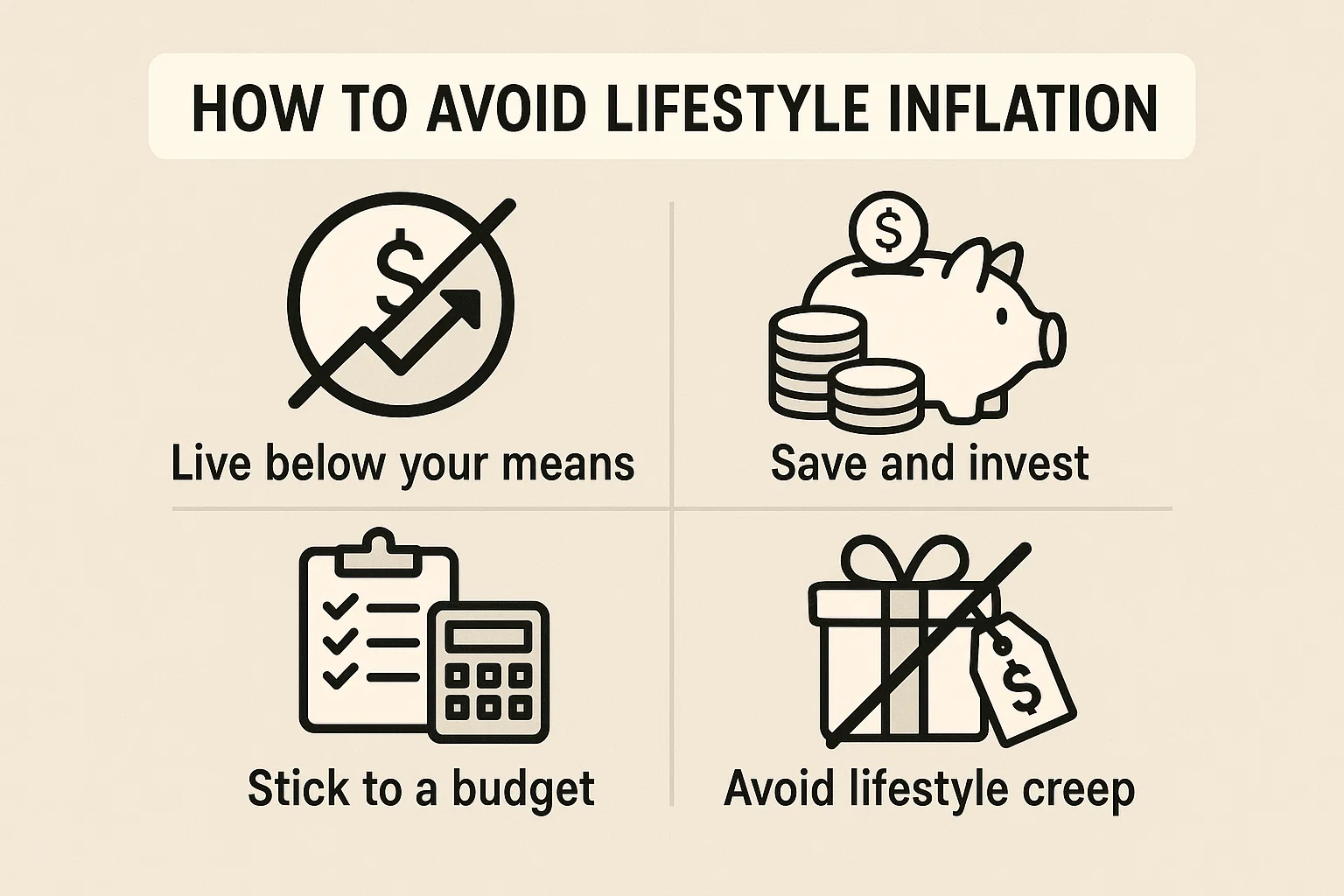

You get a raise, and suddenly you’re dining out more, upgrading gadgets, or moving to a fancier apartment.

That’s lifestyle inflation—and it can quietly kill your long-term wealth.

If you’re wondering how to avoid lifestyle inflation, this guide gives you 9 practical tips to help you grow your income without shrinking your savings.

Set savings and investment goals for every raise you get. Purpose-driven money has less chance of being wasted.

Use auto-transfer tools to move a fixed percentage of your income to savings or investments before you spend a rupee.

Don’t upgrade everything just because you can. Give yourself a 30-day wait period before making large purchases.

Track your expenses monthly and review them as your income grows—don’t let lifestyle creep sabotage your goals.

Reward yourself in non-monetary ways like a nature trip, time with family, or free hobbies rather than pricey indulgences.

More income doesn’t mean more things. Adopt a “value over price” mindset.

Ask: “Will this purchase add long-term value?” before you buy. Stay aligned with your priorities.

Lifestyle inflation hides when you only focus on earnings. Keep an eye on how much wealth you’re truly building.

Peer influence is real. Spend time with those who value saving, investing, and long-term growth.

It’s when your spending increases as your income rises—often without realizing it.

Not always. But if spending grows faster than savings or investing, it leads to financial stagnation.

Plan jointly, automate savings, and set family financial goals like home buying, travel, or education.

You can—mindfully. Avoid automatic upgrades and choose ones that align with long-term happiness and value.

Aim for at least 50% of your income increase to go toward savings or investments.

Avoiding lifestyle inflation isn’t about being cheap. It’s about being intentional.

Let your wealth grow faster than your wants, and you’ll be financially unstoppable.

💡 Follow more smart money moves at bit2050.com