Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

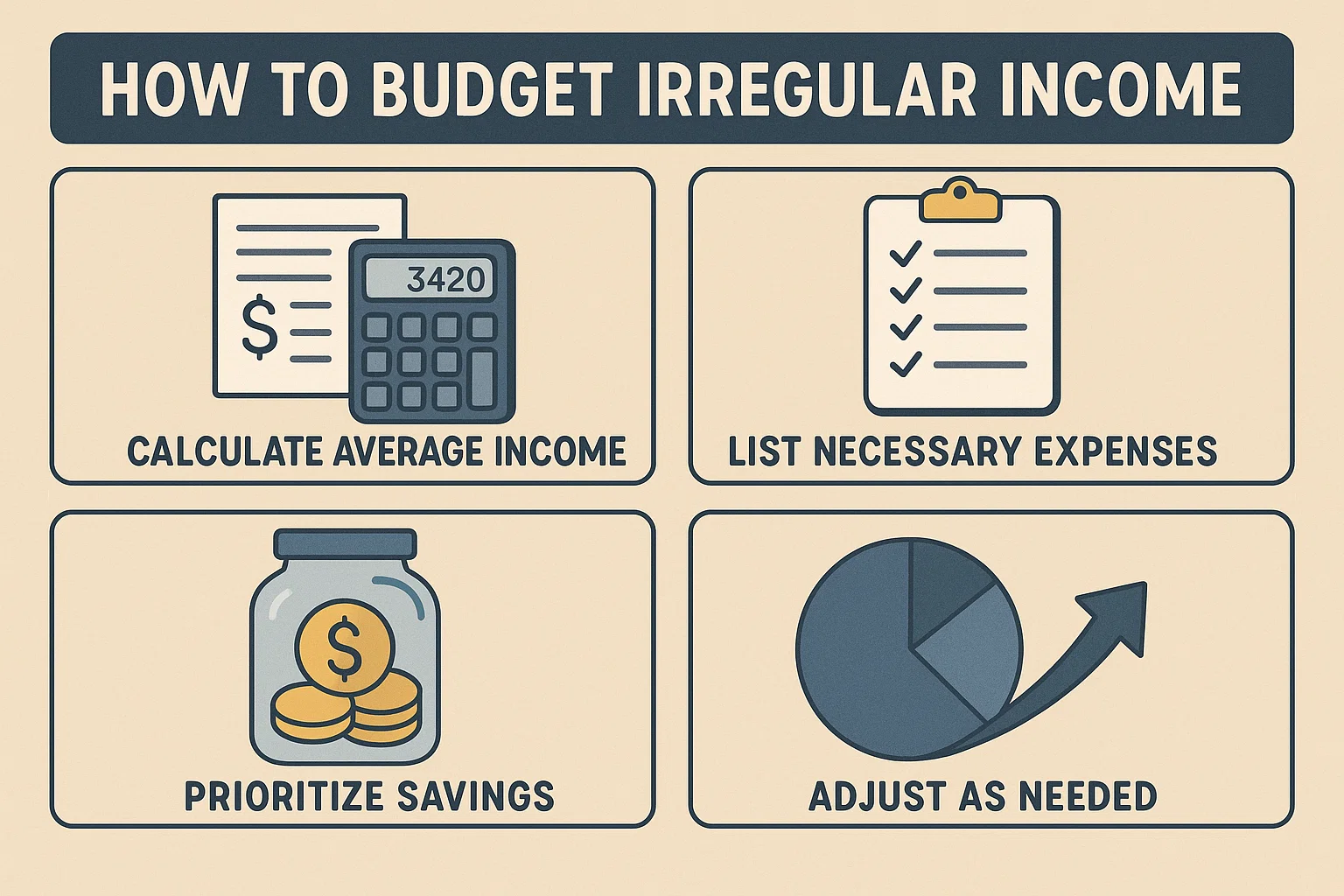

If you’re a freelancer, gig worker, or entrepreneur, you already know the struggle: money comes in waves, but bills are steady. So how do you stay financially afloat?

This is where learning how to budget irregular income becomes essential. In this guide, we’ll share 7 proven strategies to bring stability and structure to your unpredictable earnings.

Calculate your monthly essential expenses (rent, food, EMI, utilities).

👉 This is your survival budget — the amount you must cover each month.

Add your past 6 months’ earnings → divide by 6.

Use this average to build a realistic monthly budget.

Even if you earn ₹1.5L this month and ₹30K next, pay yourself a fixed monthly amount (e.g., ₹50K).

Save the surplus in a buffer account.

Aim for 3–6 months of essential expenses in a separate buffer account.

This will protect you during low-income months.

Automate essentials first:

Rent

EMI

Insurance

Utility bills

Discretionary spending comes after saving for these.

50% Essentials

30% Variable lifestyle

20% Savings/Investments

Adjust these percentages based on high/low-income months.

Use tools like Google Sheets, YNAB, or Wallet App.

Tracking prevents overspending and helps spot patterns.

| Category | Monthly Budget (₹) |

|---|---|

| Essentials | 30,000 |

| Buffer Savings | 10,000 |

| SIP/Investments | 5,000 |

| Lifestyle | 5,000 |

| Total Target | 50,000 |

Income above ₹50,000? Allocate to buffer or investments.

Freelancers, consultants, gig workers, small business owners — anyone without a fixed monthly paycheck.

Use your buffer savings to cover essentials, then replenish it when income resumes.

If needed, pause SIPs temporarily — but always restart ASAP. Consider flexible SIPs or liquid funds.

Aim for 3–6 months of essential expenses, stored in a savings account or liquid fund.

Absolutely. It just requires discipline, flexibility, and planning.

Mastering how to budget irregular income isn’t about rigid rules—it’s about building a system that keeps you calm during income drops and smart during windfalls.

Start with your minimum needs, automate your essentials, and build a strong buffer. With the right plan, you’ll thrive in financial unpredictability.

Let bit2050.com help you budget like a pro—no matter how lumpy your income is.