Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

Drowning in multiple EMIs or credit card bills? You’re not alone. In 2025, many Indians are turning to debt consolidation as a strategic way to simplify loan repayment, reduce interest costs, and regain financial peace of mind.

In this guide from bit2050.com, we break down how to consolidate debt step-by-step, explore smart tools and options, and answer FAQs to help you make informed financial decisions.

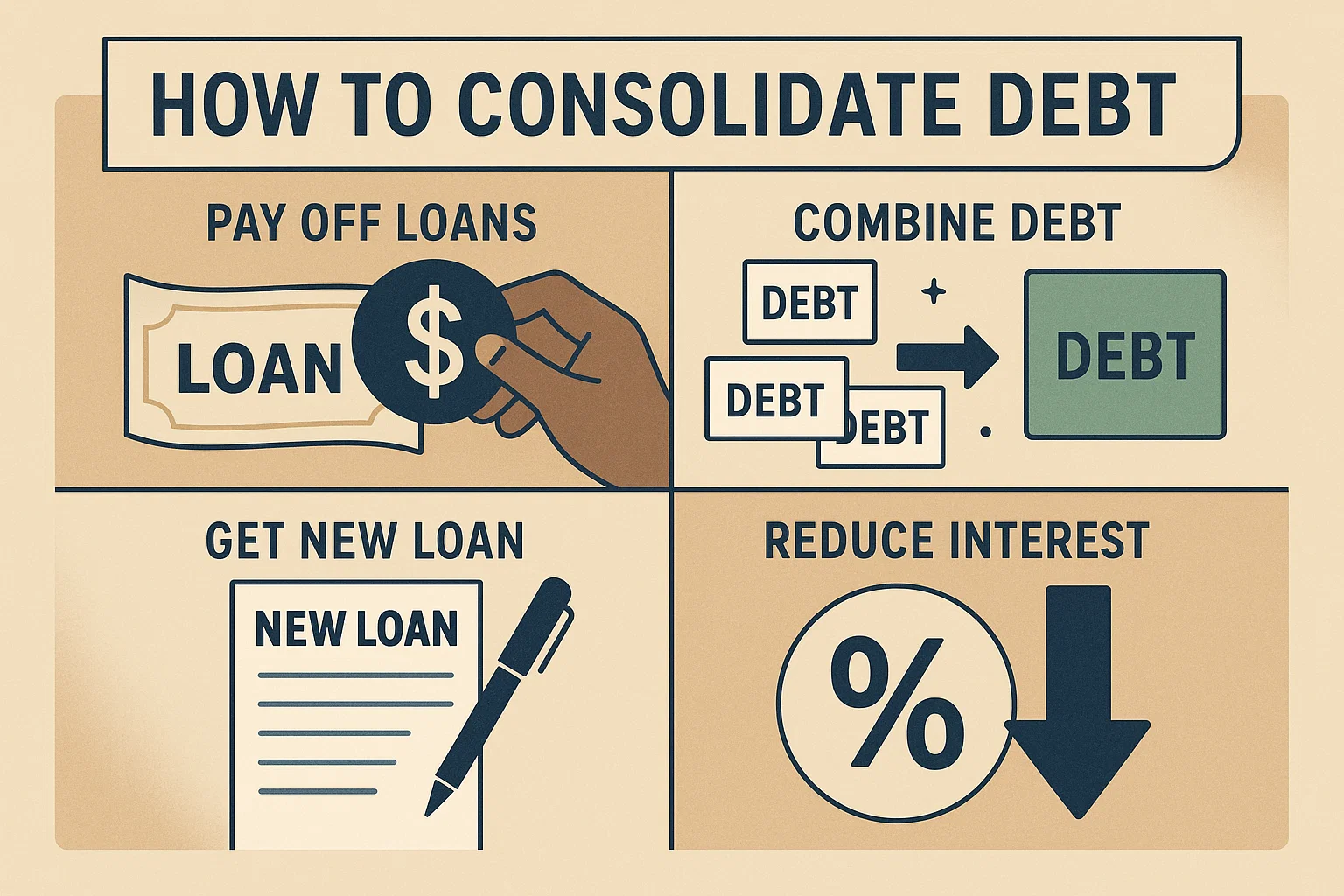

Debt consolidation is the process of combining multiple debts into one single loan — typically with a lower interest rate and a longer repayment period. It helps you:

Simplify EMI payments

Reduce interest burden

Avoid late fees

Improve your credit score over time

Apply for a low-interest personal loan and use it to pay off all other high-interest debts like credit cards or payday loans.

Transfer all outstanding credit card balances to a 0% APR credit card (introductory offer) to save on interest for 6–12 months.

Use your house or property as collateral to secure a lower-rate secured consolidation loan.

Some companies offer interest-free or low-interest loans to help employees manage debt better.

Use gold or Public Provident Fund (PPF) as collateral to get cheaper loans and clear off high-interest debts.

Non-profit organizations and certified financial planners can help negotiate and restructure your debt.

Use your bank’s EMI merger facility to combine personal loan + credit card dues into a single EMI.

| Pros | Cons |

|---|---|

| Easier to manage one EMI | Might extend repayment period |

| Lower interest costs | May require good credit score |

| Reduces stress | Some loans need collateral |

You’re paying high interest on credit cards

You’re missing EMIs or struggling with repayment

Your credit score is declining

You want to avoid bankruptcy

Initially, it may dip due to a hard inquiry, but over time, consistent payments can improve your credit score.

If your debt is high and scattered, a personal loan may offer a better fixed interest rate. For short-term repayment, 0% balance transfer cards can work.

It helps, especially for unsecured personal loans. But even with a moderate score, options like gold loans or employer loans can work.

No. Debt consolidation repays the full debt, while debt settlement negotiates to pay less than owed, which negatively affects credit.