Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

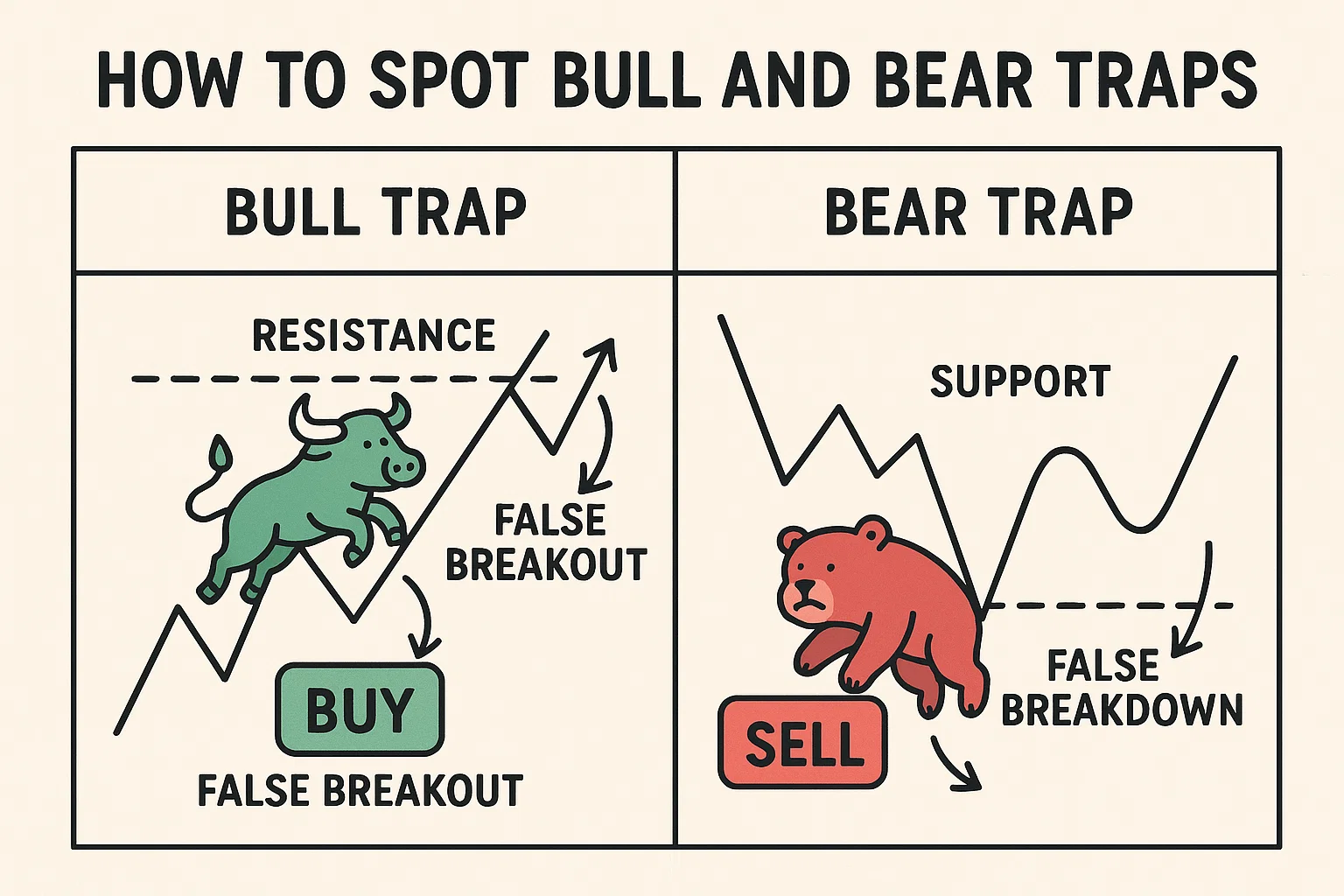

How to spot bull and bear traps is a must-know for anyone trading crypto in 2025. These traps lure traders into taking the wrong side of the market right before a reversal.

At bit2050.com, we show you how to detect and dodge these fakeouts using proven technical tools and trader psychology.

A bull trap occurs when price breaks above resistance, luring buyers in — only to reverse and crash shortly after. It’s a fake breakout that punishes FOMO-driven traders.

A bear trap is the opposite — a price dips below support, attracting shorts, then quickly reverses upwards, liquidating bears.

Genuine breakouts are supported by strong volume. Weak volume = likely trap.

If price makes a new high/low but RSI diverges, be cautious — momentum is fading.

Watch for patterns like:

Doji

Shooting Star (bull trap)

Hammer (bear trap)

Traps often occur around:

Major resistance/support

200 EMA

Fibonacci levels

Use on-chain or exchange data to check long/short ratio. Overcrowded trades = higher trap risk.

If a move happens on FOMO news or social media hype, it’s more likely to be a trap.

Never buy the breakout blindly. Wait for a retest of the level with strong volume confirmation.

A: Yes. Due to high volatility and leverage, crypto is especially prone to traps.

A: No tool is perfect. But indicators like RSI, volume, and candlestick patterns increase your odds.

A: 4H and 1D charts give better context than lower timeframes, which often show noise.

A: Always wait for volume confirmation and/or a successful retest of the breakout level.

A: In many cases, yes. Bots exploit stop-loss clusters and retail positions to cause forced liquidations.

Knowing how to spot bull and bear traps can save you from devastating losses and emotional trades. Stick to volume, momentum divergence, and confirmation signals before entering positions.

For more crypto trading psychology and risk management tools, visit bit2050.com — your strategic partner in the crypto world of 2025.