Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

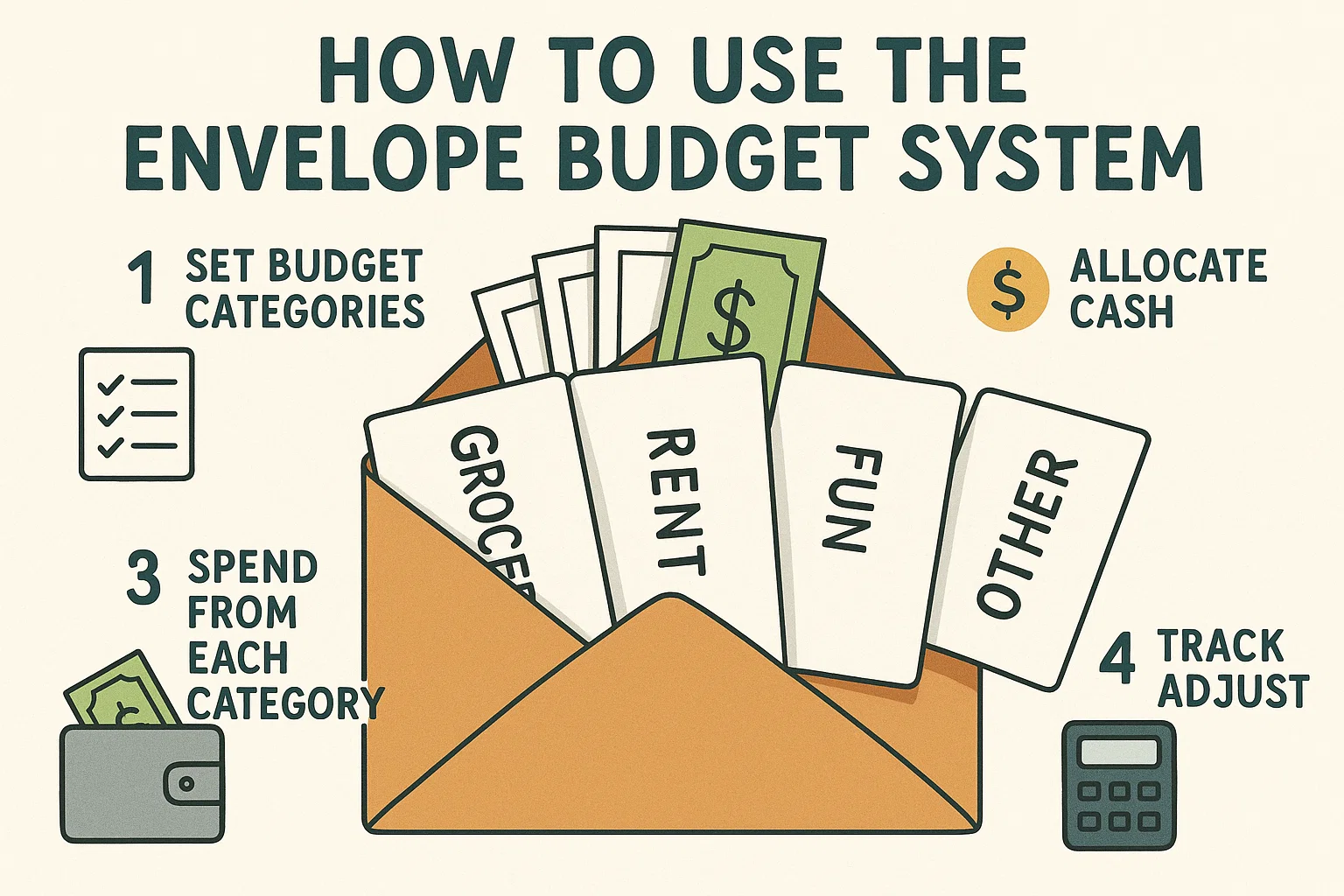

Are you struggling to manage your money each month? The envelope budget system is a time-tested, simple method to regain control over your spending — no apps or spreadsheets required.

In this guide, you’ll learn how to set it up, how it works, and how it can transform your relationship with money.

The envelope budget system is a cash-based budgeting technique where you divide your income into different spending categories — each with its own physical envelope. Once the money in an envelope runs out, you can’t spend more in that category.

It creates instant spending limits and forces discipline — perfect for people trying to break free from overspending or credit card reliance.

Examples include:

Rent

Groceries

Utilities

Transport

Entertainment

Eating out

Based on your monthly income, assign an exact amount to each category.

Example:

Groceries: ₹6,000

Transport: ₹2,000

Eating Out: ₹1,500

Withdraw the total cash amount at the beginning of the month and place the money into labeled envelopes.

If your entertainment envelope is empty, no more Netflix, movies, or hangouts — until the next month.

At the end of each month, note which envelopes had money left and which were exhausted. Adjust next month’s budget accordingly.

Builds strong money discipline

Reduces impulse purchases

Keeps you aware of your spending habits

Simple and offline — no tech required

Ideal for beginner budgeters

Not ideal for online payments

Physically carrying cash can be inconvenient

🔄 Modern hack: Use digital wallets with category-based budgeting like Fi, YNAB, or Goodbudget.

Yes. While cash is less used today, the principle of intentional spending and category-based budgeting is timeless.

You must wait until the next budget cycle or adjust from another envelope — this builds spending discipline.

Yes! Apps like Goodbudget, YNAB, or Fi allow envelope-style planning without using cash.

Ideal for:

Beginners in personal finance

People who overspend

Those trying to get out of debt

Alternatives include the 50/30/20 rule, zero-based budgeting, and automatic savings plans.

The envelope budget system might sound old-school, but it works. If you’re serious about cutting expenses, saving more, and avoiding financial stress, this could be the perfect start.

👉 Ready to master your money? Visit bit2050.com for more smart budgeting strategies.