Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

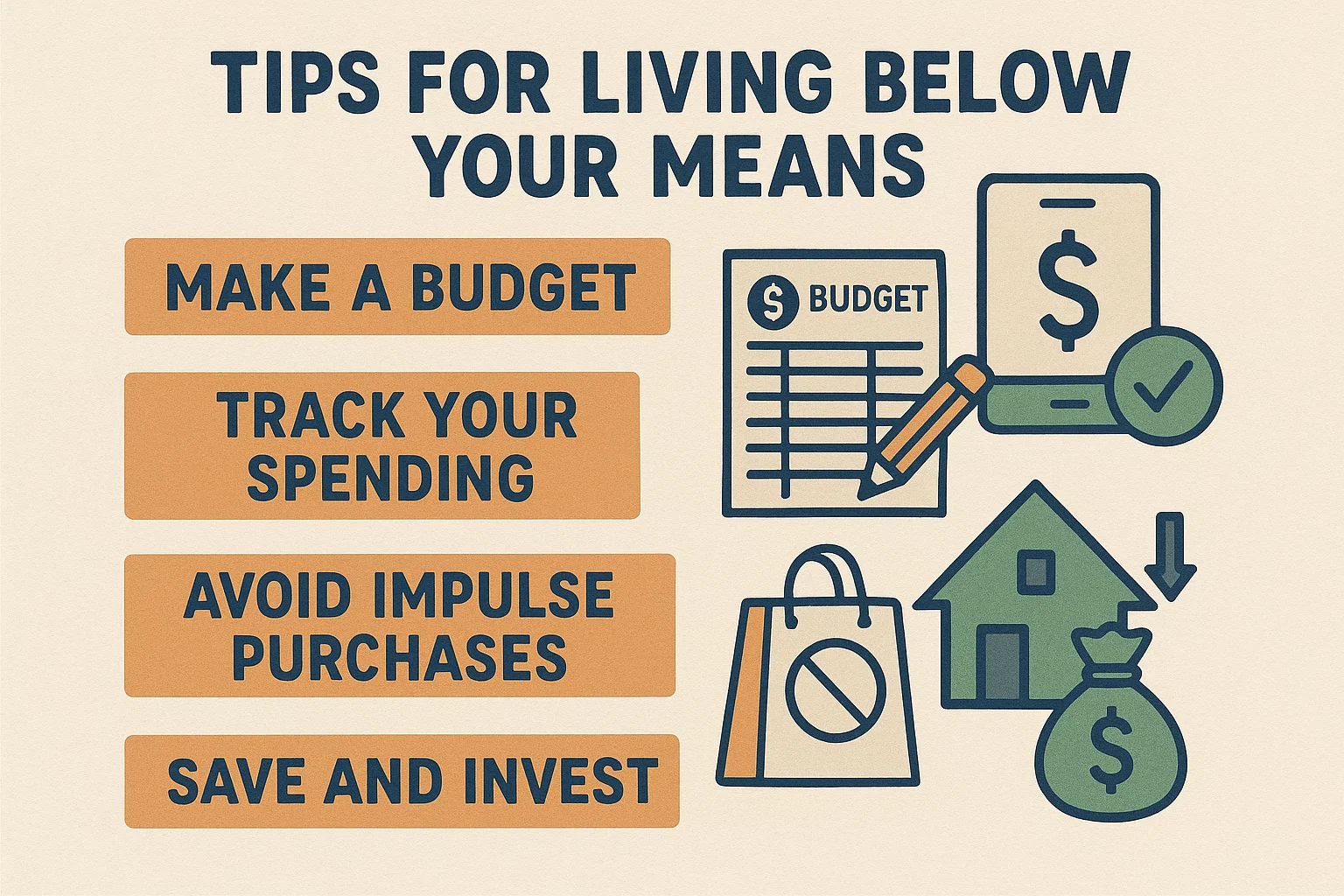

Tips for living below your means: If you’re always chasing the next paycheck, it’s time for a mindset shift. The wealthiest people often follow one golden rule: live below your means.

Mastering the art of spending less than you earn isn’t about deprivation — it’s about freedom, control, and peace of mind. Here are 9 powerful tips for living below your means and building real financial security.

Start by knowing where your money goes. Use an app, spreadsheet, or journal to monitor daily spending habits.

Budgeting isn’t just for low earners. It’s a strategy to prioritize savings, debt repayment, and mindful spending.

Credit cards tempt you to overspend. Try the “cash envelope” or “UPI limit” method to stay accountable.

Dining out drains your budget quickly. Cooking at home is healthier and dramatically cheaper.

Follow the 30-day rule. Wait before big purchases to avoid impulse buying and evaluate true need.

Just because you earn more doesn’t mean you should spend more. Lock in your current lifestyle and save the raise.

Sell unused items and pocket the money. It clears space and boosts your savings instantly.

Opt for durability over discount. Long-lasting products reduce replacement costs.

Pay yourself first. Set up auto-debits for SIPs, FDs, or recurring deposits before spending a single rupee.

It means spending less than you earn, so you can save and invest for your future instead of living paycheck to paycheck.

Not at all. It’s about being intentional with money, not depriving yourself. Frugality = freedom, not sacrifice.

Absolutely! You just prioritize your spending on what truly matters — and cut the rest.

A good benchmark is saving at least 20% of your income, but even 10% is a strong start.

Yes — many millionaires live below their means. It’s how they stay wealthy and financially resilient.

Adopting these tips for living below your means will shift your financial future.

It’s not about having less. It’s about worrying less, saving more, and building lasting wealth.

Start small. Stay consistent. And let your money work for you — not against you.

👉 Explore more wealth-building strategies at bit2050.com