Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

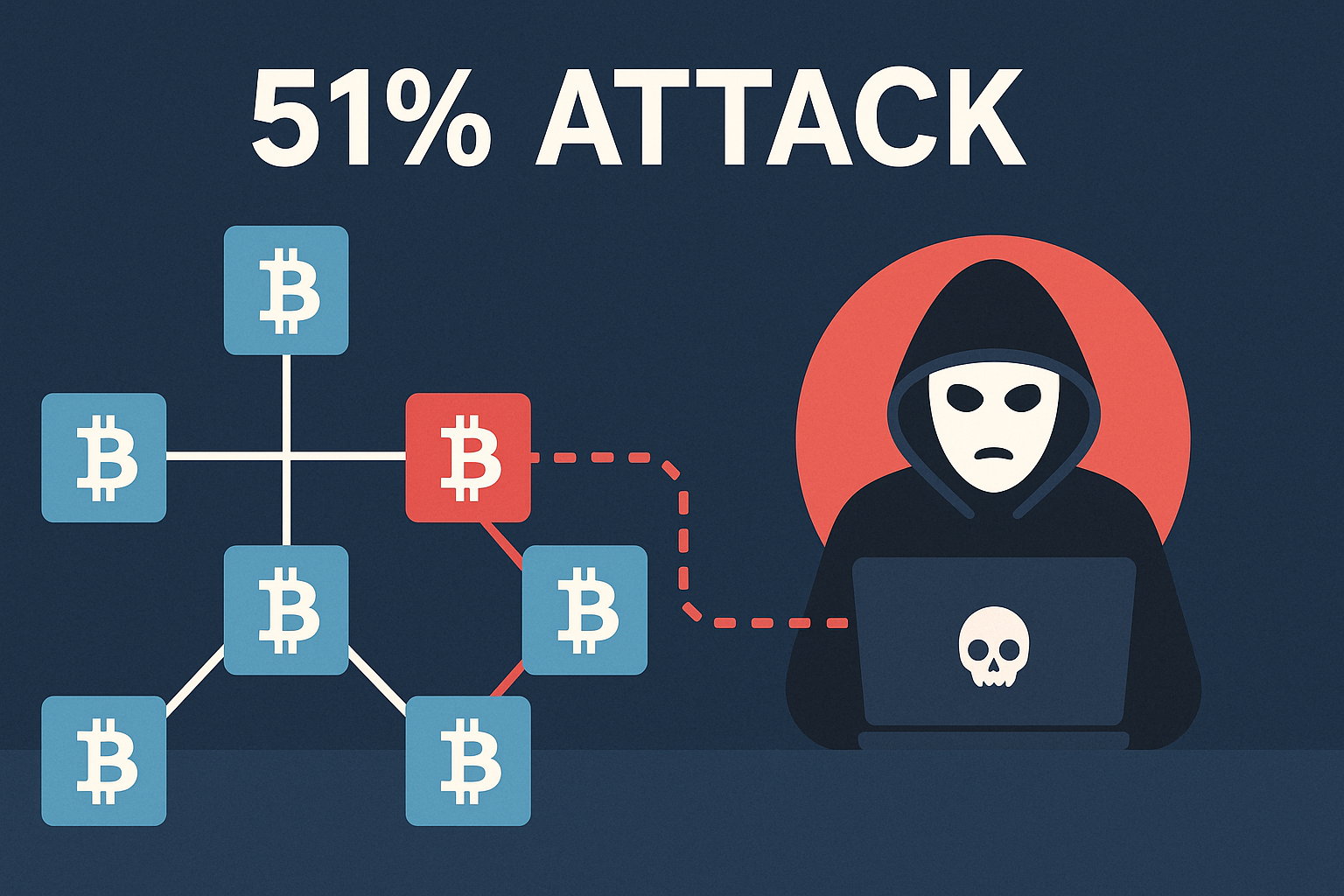

The security of blockchain technology lies in its decentralized nature. But what happens when one entity controls the majority of a network? That’s when a 51% attack becomes a major threat.

At bit2050.com, we break down what is a 51% attack in crypto, how it works, and why it’s one of the most dangerous vulnerabilities in blockchain networks — especially those using Proof of Work (PoW) consensus.

A 51% attack occurs when a single miner or group of miners controls over 50% of a blockchain network’s total hashing power (in PoW systems).

With this majority control, they can:

Manipulate the blockchain ledger

Reverse transactions (double-spending)

Halt new transactions from being confirmed

Prevent other miners from earning rewards

In simple terms: if one player controls the majority, they can rewrite history — at least temporarily.

While decentralization is a blockchain’s strength, smaller PoW chains with limited hash power are vulnerable.

✅ Bitcoin is secure due to massive hash power

❌ Smaller chains like Ethereum Classic and Bitcoin Gold have suffered 51% attacks

An attacker can reverse their own transactions, allowing them to:

Spend crypto on an exchange

Withdraw assets

Rewrite the chain to show it never happened

✅ This is known as double-spending, and it breaks the trustless system of blockchain.

In PoW:

You control the chain if you control the majority hash rate

In PoS:

You’d need to own or stake 51% of all tokens, which is much costlier and riskier

✅ PoS systems are generally more resistant to 51% attacks.

Famous 51% attack examples:

Ethereum Classic (ETC) – Attacked multiple times in 2019–2020

Bitcoin Gold (BTG) – Lost over $18M in 2018

Vertcoin (VTC) – Attacked in 2018 and 2019

✅ Each attack caused major trust damage and delistings from exchanges.

A successful 51% attack lets the attacker:

Disrupt consensus

Freeze or censor transactions

Undermine confidence in the network

✅ It’s less about stealing coins, more about breaking trust.

Websites like Crypto51.app show:

Estimated cost per hour to attack various PoW chains

BTC: Over $1M/hour

ETC: As low as $5K/hour at its weakest

✅ The cheaper the chain to attack, the more dangerous it is.

Solutions include:

Increasing hash power

Switching to PoS (like Ethereum did)

Adding finality layers or checkpoints

Monitoring mining pools

✅ The community must stay alert to maintain decentralization and network health.

A: Technically yes, but it’s extremely unlikely due to its massive hash rate and decentralization.

A: Transactions may be reversed, double-spending occurs, and the network’s trust is damaged.

A: PoS makes 51% attacks economically impractical because attackers risk losing their staked assets.

A: No. It can reverse its own transactions, but not steal directly from others’ wallets.

A: Avoid investing in low-hash PoW chains, and track network activity using public monitoring tools.

Now you know what a 51% attack in crypto is — and why it’s one of the most feared exploits in blockchain. While rare on top networks, smaller chains are vulnerable, and understanding this risk is key to smart crypto investing.

For deeper insights into blockchain security, PoW vs PoS, and the future of crypto safety, explore more on bit2050.com — your trusted source for the decentralized future.