Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

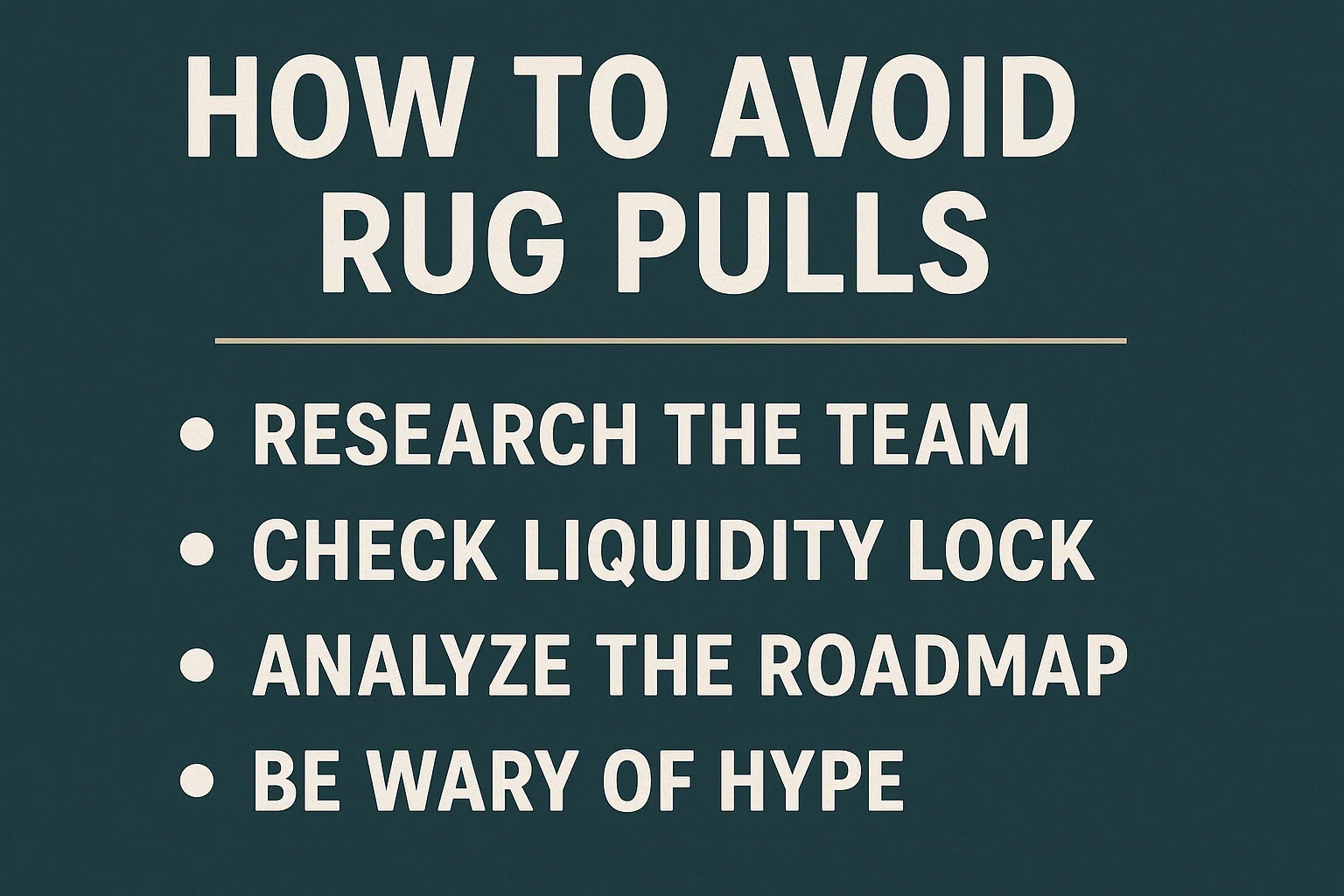

With thousands of tokens launching every month, rug pulls remain one of the most devastating crypto scams. In a rug pull, developers drain liquidity or abandon a project after luring in investors.

But you can protect yourself. Here’s how to avoid rug pulls in crypto using 9 proven tips, curated by bit2050.com.

Is the team doxxed (publicly identified)?

Check their LinkedIn, GitHub, or Twitter

Anonymous teams = higher rug pull risk

Red flag: No background, fake photos, or no social proof.

Legit projects have clear roadmaps, tokenomics, and long-term plans.

Scam tokens usually have vague, copy-pasted whitepapers or unrealistic promises.

Has the smart contract been audited by a trusted firm (e.g., CertiK, Hacken)?

If not, any backdoor function could allow devs to rug pull at any moment.

A key metric:

Has the liquidity been locked (e.g., via Unicrypt, PinkLock)?

For how long?

Unlocked liquidity = risk of instant rug pull.

Beware of:

Huge percentage owned by dev wallets

Low liquidity vs. market cap

Use tools like DexTools.io or TokenSniffer

Is there a sudden spike in volume and price followed by silence?

This could indicate pump-and-dump activity or a setup for a rug.

Active Telegram, Discord, or Twitter communities can reveal red flags:

Are devs responsive?

Is the chat filled with bots or hype without substance?

If you’re unsure, do a small buy and sell test.

Some scam tokens block selling or charge 99% fees.

Use scanners to assess risk scores:

TokenSniffer

RugDoc

GoPlusLabs

A: A rug pull is a scam where developers drain the liquidity or abandon a project after collecting investor funds.

A: Yes. Volume alone isn’t a sign of safety. Examine liquidity locks, contract audits, and team transparency.

A: Use platforms like Unicrypt or search on Etherscan/BSCScan for LP lock transactions.

A: A honeypot is a smart contract trap where you can buy but cannot sell the token—another scam tactic.

A: No, but KYC adds a layer of accountability. Combine it with contract audits and tokenomics checks.

In 2025, rug pulls may evolve—but so can your defenses. Use this checklist every time you evaluate a new token or DeFi project. Protect your funds, and stay smart.

Visit bit2050.com for more guides on crypto safety, investing strategies, and DeFi analysis.