Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

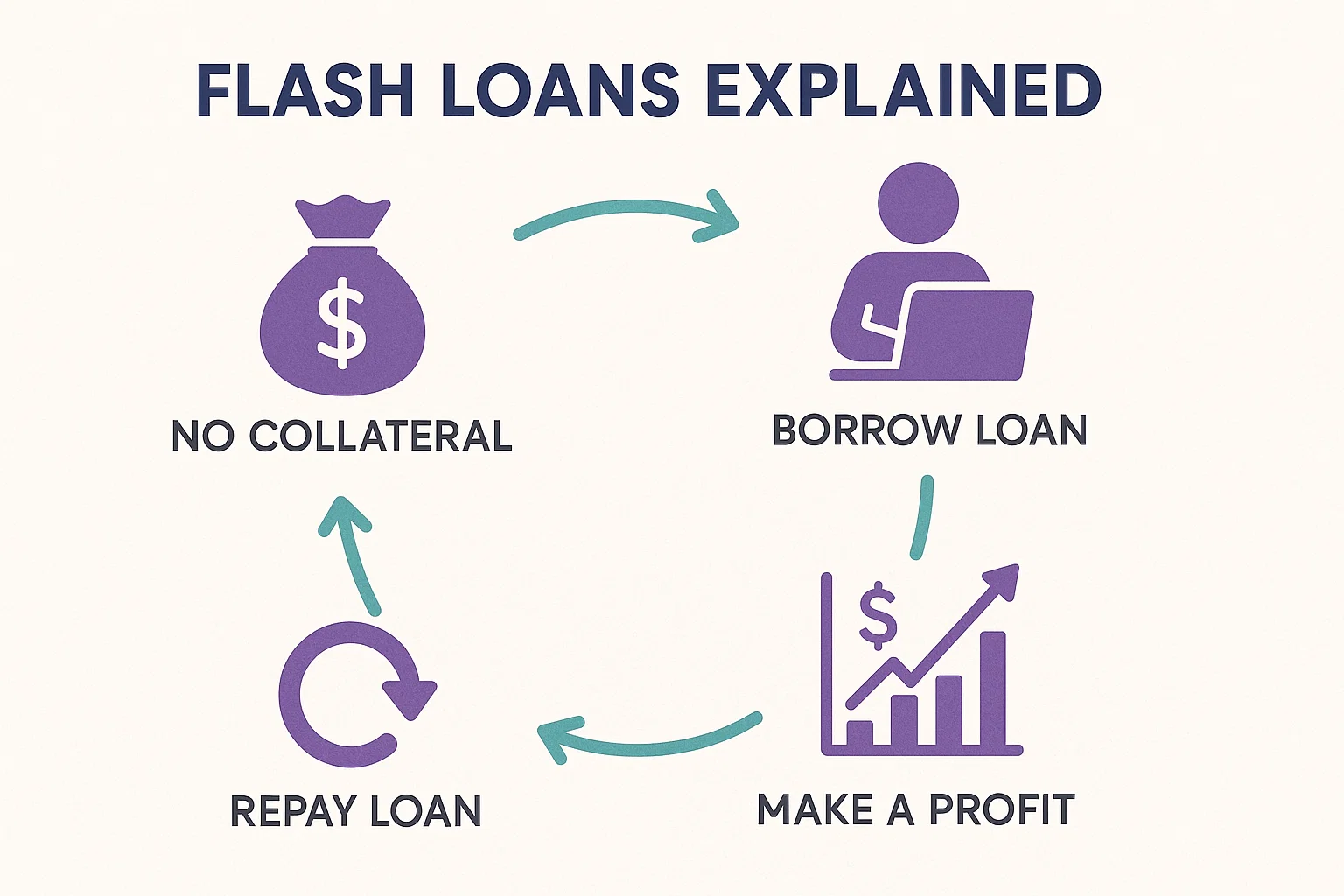

Flash loans are one of the most fascinating — and risky — innovations in the DeFi world. In this article from bit2050.com, we’ll explore flash loans explained for beginners and advanced users alike.

Unlike traditional loans, flash loans require no collateral and are completed in a single blockchain transaction. Sounds magical? Let’s break it down.

Flash loans are instant, uncollateralized crypto loans that must be:

Borrowed

Used

Repaid

All within one transaction block.

If the borrower fails to repay instantly, the transaction automatically fails — and the loan never exists.

Flash loans are powered by smart contracts on platforms like:

Aave

dYdX

Uniswap (via arbitrage bots)

Borrow funds via a smart contract

Use the funds for arbitrage, swaps, liquidation, etc.

Repay within the same transaction

If Step 3 fails → the entire transaction is reversed.

Buy low on one DEX, sell high on another, and keep the profit — instantly.

Move positions across DeFi platforms without needing collateral upfront.

Bots use flash loans to liquidate undercollateralized loans on lending platforms.

No Collateral Needed

Zero upfront capital — only smart contract logic.

Risky for Protocols, Not Lenders

You risk nothing as a borrower, but platforms are vulnerable.

Exploited for Multi-Million Dollar Hacks

Flash loan attacks have drained hundreds of millions from DeFi protocols.

Can Manipulate Oracles

Some hackers manipulate price feeds temporarily to profit from false pricing.

Used by MEV Bots

Miner Extractable Value bots use flash loans to front-run other transactions.

Legal but Controversial

They’re not illegal — but often blur the line between arbitrage and exploitation.

Growing Fast

As smart contract security evolves, flash loan volumes are increasing year-on-year.

A: No. They usually have a small fee (0.09–0.3%) charged by the protocol.

A: Yes, but you must know how to write or use smart contracts that repay instantly.

A: For platforms — yes. For borrowers — not directly, since it’s all atomic.

A: To gain temporary massive buying power to manipulate prices or exploit bugs.

A: Absolutely. Arbitrage, refinancing, and risk-free trading are all valid.

Understanding flash loans explained is essential for anyone serious about DeFi. While they offer brilliant tools for advanced traders and developers, they also pose serious risks when misused.

To stay updated on all DeFi tools and threats, follow bit2050.com — your trusted crypto knowledge source.