Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

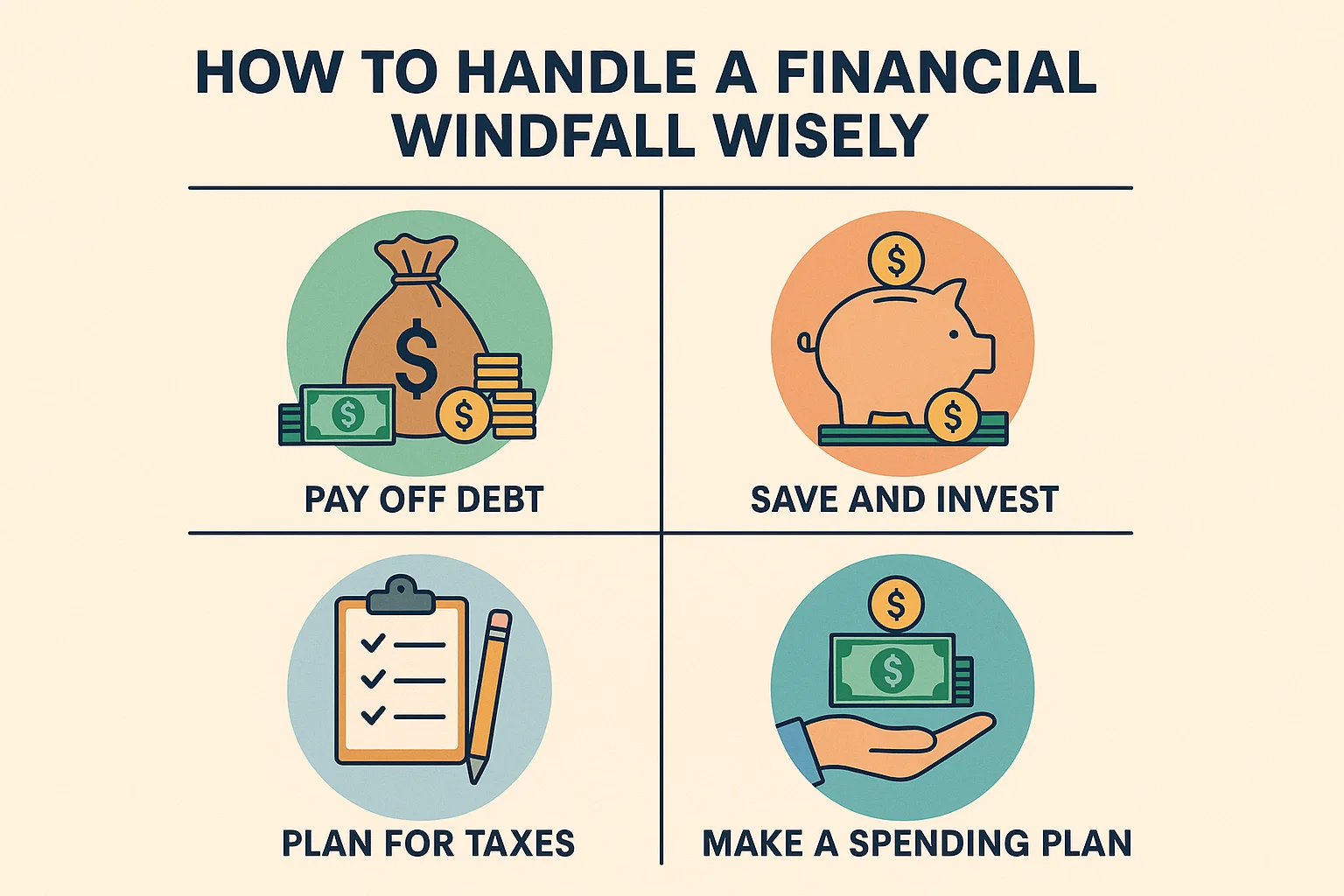

Whether it’s a sudden bonus, an inheritance, a lottery win, or proceeds from a property sale — a financial windfall can be both exciting and overwhelming.

Many people blow through windfalls because they don’t plan. In this guide, we’ll show you how to handle a financial windfall wisely, with 7 smart, proven steps that help you protect, grow, and enjoy your new wealth.

Before buying a new car or booking a luxury trip, pause. Let the emotional excitement settle so you can make clear, logical decisions.

📌 Pro Tip: Park the money in a liquid fund or short-term FD temporarily.

Each type of windfall is taxed differently in India.

Lottery winnings: Flat 30% TDS

Inheritance: Not taxable, but capital gains on future sale apply

Bonus/ESOPs: Taxed as per income slab

✅ Consult a CA to optimize taxes legally.

Before investing, clear high-interest loans like:

Credit card balances

Personal loans

Buy Now Pay Later (BNPL) dues

This gives you guaranteed returns by eliminating future interest costs.

Make sure you have at least 6 months of expenses parked safely in:

Liquid mutual funds

High-interest savings accounts

Short-term FDs

Don’t leave the entire windfall idle. Based on your risk appetite and goals, invest in:

Index funds or mutual funds

PPF, NPS, or gold ETFs

Real estate (only after thorough research)

✅ Always diversify and follow asset allocation principles.

Use a portion of the windfall to review and upgrade your:

Life insurance (Term Plan only)

Health insurance (₹10 lakh+ coverage)

Critical illness or accident cover

Sit down with a fee-only planner or use a tool like Goalwise, Kuvera, or Zerodha Coin to align this windfall with your future milestones:

Retirement

Home down payment

Child’s education

Startup fund

Any unexpected lump sum income like lottery winnings, inheritance, insurance payouts, large bonuses, or property sales.

No. First clear debts, build emergency savings, and plan tax-efficient strategies before investing.

No inheritance tax in India, but capital gains tax applies if you sell the inherited assets later.

Only inform trusted family members or a financial advisor. Avoid unnecessary attention that may lead to pressure or scams.

Absolutely — just cap fun spending at 5–10% of the total windfall to enjoy guilt-free without harming your long-term plan.

Receiving a financial windfall can be a life-changing moment — if handled wisely. Don’t rush. Protect yourself, plan smartly, and let your money work for you.

Explore more financial wisdom at bit2050.com – your trusted guide for wealth-building in the digital era.